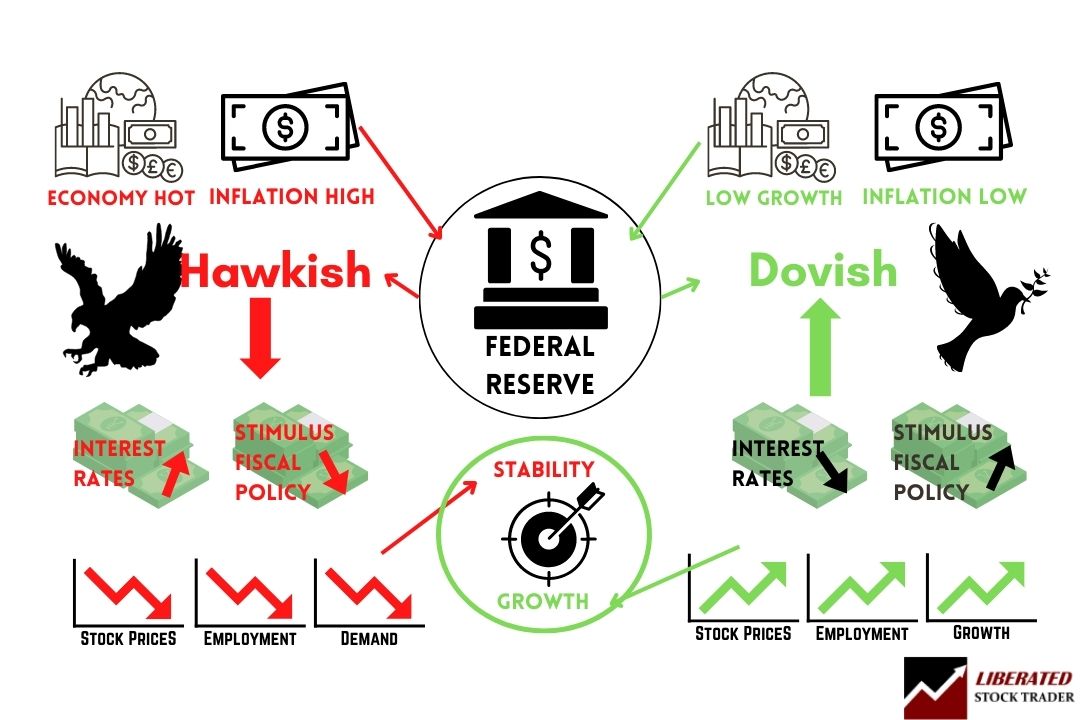

Hawkish vs. dovish refers to the policy stance of the Federal Reserve governors. Hawks are prepared to swoop down to restrict growth in an overheating economy. Doves want the economy to fly by reducing interest rates to boost investment, employment, and growth.

But what exactly do these terms mean? And why do they matter to investors? Here’s a quick rundown on each side.

When deciphering the actions and statements of the Fed, a good place to start is by understanding the difference between hawks and doves. Hawks tend to be more worried about inflationary pressures, while doves are more concerned with ensuring economic growth. This hawk-dove split can explain how the Fed may act in any given situation.

In this blog post, we’ll explore what each group tends to advocate for and look at some examples of recent events that this division has influenced. By better understanding hawks and doves within the Fed, investors can gain a clearer picture of what might lie ahead for monetary policy.

Key Takeaways

- The Federal Reserve has been a key player in the American economy since its inception

- The Fed is made up of influential doves and hawks who have shaped its policies over the years

- Doves favor loose monetary policy, while hawks prefer tighter conditions

- The goal of the Federal Reserve is economic stability and growth

- Hawks are concerned about inflationary pressures and stopping asset bubbles that impact stability.

- Doves focus on improving economic growth and employment.

Hawkish vs. Dovish in the Federal Reserve

Dovish and hawkish are terms used to describe the monetary policies of the United States Federal Reserve and other central banks. A dovish stance means that the Federal Reserve leans towards lower interest rates and is more willing to engage in quantitative easing. In contrast, a hawkish stance indicates that the Fed may raise interest rates or tighten monetary policy to control inflation. A dovish position may also be characterized by rhetoric from central bankers suggesting an expansionary fiscal agenda, such as growth spending on infrastructure and clean energy. In contrast, a hawkish outlook may include high-level actions such as raising taxes or reducing government spending to bridge budget deficits. Regardless of which stance is taken, both have important implications for national economic performance and, thus, should not be taken lightly.

In short, a dovish stance by the Fed seeks to maintain low interest rates and a steady economy. Conversely, a hawkish stance seeks to raise interest rates to control inflation and slow economic growth.

The tools used by doves & hawks to affect the economy

The primary tools used by the Federal Reserve to implement either a dovish or hawkish policy is open market operations and interest rate changes.

Open market operations involve buying and selling US Treasury notes, sometimes with the intention of changing the money supply. By altering these parameters, the Federal Reserve can affect macroeconomic indicators such as GDP growth, inflation, unemployment rates, and consumer spending.

How The Economy & Business Cycle Dictates The Feds Hawkish or Dovish Policy

In 2008 during the global financial crisis, the bubble burst in the property market, causing homelessness, increased unemployment, a stock crash, and consumer panic. These factors forced Central Banks into a strong dovish policy of injecting capital into the economy through stimulus, fiscal policy, and reduction in interest rates.

While this dovish policy saved the economy, many argue it caused an overheated economy, leading to the 2022 crash.

In 2022/23, the economy is running too hot; high inflation, labor shortages, and asset bubbles in cryptocurrency, property, and stocks affect economic stability. To counter overheating, the Federal Reserve and other central banks need to adopt hawkish policies to slow down growth and cool the economy.

What is Hawkish vs. Dovish related to the business cycle?

Hawkish and dovish refer to the monetary policies of the Federal Reserve, which are used to influence the business cycle. A hawkish stance indicates that the Fed may raise interest rates or tighten monetary policy to control inflation and economic growth. This type of policy is often used during periods of economic prosperity when GDP growth is high and inflationary pressures are rising. A hawkish stance aims to keep inflation in check by controlling wages and reducing consumer spending.

Conversely, a dovish stance means that the Federal Reserve is biased towards lower interest rates and is more willing to engage in quantitative easing. This policy is usually adopted at the bottom of the business cycle, during economic downturns when GDP growth slows, and unemployment rises. Its goal is to encourage investment and stimulate job growth by making it easier for businesses to borrow money at lower interest rates. By lowering interest rates, the Fed hopes to incentivize consumers to spend more and businesses to invest more in their operations.

How do Hawkish and Dovish Policies Affect the Stock Market?

Hawkish and dovish policies can have a significant impact on the stock market. When interest rates rise, monetary policy tightens, restricting business access to credit, and stifling profits and the capital needed for expansion and innovation. This can cause stock prices to fall as investors look to other investments with less risk.

Conversely, when the Federal Reserve adopts a dovish stance and lowers interest rates, it makes borrowing more affordable for businesses and individuals. This can lead to increased demand for certain stocks as businesses have more access to credit, and investors look for companies with strong fundamentals. When a dovish policy is in place, it can lead to increased stock prices as companies are able to expand and grow more easily.

Why does the Fed change its stance between hawkish and dovish?

The Federal Reserve might sometimes adopt a combination of hawkish and dovish policies depending on how different macroeconomic indicators develop over time. For instance, if inflation starts increasing while GDP growth remains low, then a combination of both policies could be adopted to rein in inflation without stifling economic recovery efforts. Similarly, if GDP growth accelerates while inflation remains low, then dovish policies could be implemented to avoid any potential overheating without stifling economic activity too much.

Why understanding dovish and hawkish policy is important for investors?

Ultimately, understanding the differences between hawkish and dovish stances will help investors determine what type of monetary policy may be adopted by the Federal Reserve at various points during an economic/business cycle. This can be beneficial for making smart investment decisions as it will provide clues as to whether it’s better to invest in stocks or bonds depending on what type of environment may exist within each business cycle phase.

The Pros of Hawkish Federal Policy

The primary pro of a hawkish Federal policy is that it can help to mitigate the risk of inflation or let the air out of asset bubbles. The Federal Reserve can limit spending and reduce aggregate economic demand by raising interest rates and tightening the money supply. This will create an environment where goods, services, and wages become cheaper by decreasing consumer spending.

The Cons of Hawkish Federal Policy

A hawkish Federal policy can have some negative consequences, as increasing interest rates makes it more difficult for businesses to borrow money and invest in new projects. This can lead to decreased investment spending, which may slow economic growth and lead to job losses. Additionally, higher interest rates can negatively affect consumer spending as people must pay higher interest rates to borrow money or buy property, which reduces their disposable income. This can lead to a decrease in consumption and slow economic growth even further.

The Pros of Dovish Federal Policy

The pros of a dovish Federal policy are that it is designed to help stimulate economic growth. By lowering interest rates and increasing the money supply, businesses can more easily borrow money and invest in new projects. This will lead to job creation and increased consumer spending, which can help to stimulate economic growth.

The Cons of Dovish Federal Policy

The cons of a dovish Federal policy are that it can lead to an increase in inflation. Increasing the money supply makes it easier for businesses and consumers to borrow money and spend more. This can cause a surge in aggregate demand, driving up the prices of goods and services. Additionally, if too much money is pumped into the economy, it can lead to an imbalance between supply and demand, which can cause asset bubbles.

Overall, understanding the differences between hawkish and dovish policies can benefit investors as it will provide clues as to what type of environment may exist within each business cycle phase. This can help them make more informed investment decisions and potentially capitalize on opportunities created by shifts in Federal policy.

Examples of how being dovish or hawkish can affect economic decisions.

There are two distinct attitudes when it comes to economic decisions: being dovish or hawkish. In a dovish scenario, the government, or other decision-makers, intend to keep inflation rates low and focus on reducing unemployment. To achieve this end, they are typically willing to use expansionary policies such as monetary easing and tax cuts.

A hawkish attitude is one in which the decision makers take a more restrictive approach towards the economy; for example, by increasing interest rates and keeping tight control of the budget. This can be beneficial in controlling inflation and preventing financial instability but can come at the cost of reduced economic growth.

Ultimately, dovish or hawkish decision-makers use a wide range of economic tactics to foster growth and stability.

Why are there different opinions on whether being dovish or hawkish is better for the economy?

Opinions vary on when it is best for economic policy to be dovish or hawkish. Those who lean toward a more dovish approach often argue that monetary policy should be more flexible and forgiving when shocks occur in the financial system. To combat weak growth, they believe that a central bank should use low interest rates and other forms of quantitative easing as a way to stimulate the economy.

On the other side, hawks stress the importance of fiscal or monetary discipline during economic booms and view inflationary pressure as an immediate threat to economic stability. Therefore, they advocate for higher interest rates and less government interference to keep inflation in check. Ultimately, whether an economy benefits from an explicitly dovish or hawkish stance will depend on its unique circumstances at any given time.

The most famous doves and hawks in the Fed’s history

Throughout its history, the Federal Reserve System has seen its share of policy debate between those advocating for a “dovish” approach, such as easing economic conditions to place downward pressure on inflation and growth, and those who hold a more “hawkish” set of views, including raising interest rates to put an end to high levels of spending and inflation.

Perhaps the most famous dove was then-Fed Chairman Alan Greenspan, who assumed office from 1987 until 2006 and is credited with keeping the economy on track during some of the toughest economic times in US history. However, Greenspan’s dovish approach and vast deregulation ultimately led to the 2008 financial crisis.

On the flip side, current Fed Chair Jerome Powell is considered hawkish for his risk-averse policymaking approach and emphasis on fiscal responsibility. Regardless of where they fall on the spectrum of opinion, these prominent individuals have all played a part in furthering our understanding of how monetary policy affects the American economy.

Doves vs. Hawks Summary

Regarding the Federal Reserve, there are two main camps: doves and hawks. Doves tend to prioritize economic growth and job creation, while hawks emphasize keeping inflation in check. Both approaches have pros and cons, which is why there is often debate about which is better for the economy. Some of the most famous members of the Fed have been doves or hawks, depending on their views at the time. Today, several members of the Fed Board lean either way.

In short, doves favor easier monetary policy, while hawks prefer tighter conditions. Both have pros and cons, which is why there are different views on whether being dovish or hawkish is better for the economy. Some of the most famous doves and hawks in the Fed’s history include Marriner Eccles, William McChesney Martin Jr., Alan Greenspan, and Janet Yellen. At present, it seems that most members of the Fed Board lean towards being dove-ish in their approach to monetary policy. If you want to learn more about economics and fundamental analysis, sign up for our professional investing training course today.

As you continue your investing journey, it’s important to learn more about economics and fundamental analysis so that you can make informed decisions about where to invest your money. With our professional investing training course, you’ll be well on your way to becoming a successful investor.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

Source link

#Hawkish #Dovish #Understanding #Doves #Hawks #Fed