VIDEO TRANSCRIPT

U.S. Dollar Index ($DXY)

Hello everyone. Welcome back. My name is Greg Firman and this is the VantagePoint AI Market Outlook for the week of November the 21st, 2022. Now to get started this week, we’ll begin where we always do with the US dollar Index. Now very few sellers of the dollar in general this past week. We can see that after the volatility of the previous week, we’ve got the PPI number. The Fed can officially start counting, in my opinion, as the best language that I could use by, because we’ve got a slightly lower CPI number and a slightly lower PPI number. However, the Fed has been very, very clear on his position, despite the fact the media keeps spinning this, that the Fed is going to pause, he’s not going to hike any further. The Fed has said no such thing to dispel that myth right now, the Fed has actually, Bullard has come out last week even further hawkish suggesting they could be going to five, even 7% before inflation is under control.

So that narrative that the Fed is going to pause is extremely unlikely, but the event risk this coming week will of course be the Fed minutes. So we will get a better insight as to what the entire committee thinks in which way they’re going. But in my respectful opinion only they’ve been crystal clear as to what they’re going to do and they’re not budging from their 2% inflation target. So the dollar pausing out here, it is a holiday short next week, a holiday, short week, next week, excuse me, with the US Thanksgiving. Notoriously volatile week. So the dollar here we have, the way the charts are set up, I’ve got the neural index with the neural index strength, the predicted differences, the medium and long term predicted differences, and this is what will be used for this week’s presentation. With of course, the verified zones and the weekly, the monthly, and the yearly opening price.

So the dollar’s still in a very firm up trend. The yearly opening price, 95.64, that is indisputable. When we look at the dollar, the dollar has been extremely bullish the entire calendar year. Right now, we’ve got a newly formed verified support low that’s coming in at about 105.34, and that is very, very close to the 200-day moving average. Also that the market will be watching very closely. We briefly dip below it and then immediately move back up. So the structure right now, our TCross Long 108.86, we have again the neural index strength. Now this is the difference. The neural index is red, green or yellow, red being down, green being up, yellow being cautious like a set of streetlights. But the neural index strength itself, it allows us to see inside the neural index as to whether it’s continuing to slope down or it’s slowly reversing the other way.

So when we look at this, you can see that the neural index started rising right at the beginning of last week. We had another dip, but the neural index continued neural index strength, excuse me, continued to advanced higher. Then finally, we broke above the zero line, and now our neural indexes turned green. We look at the medium term crossing the long term predicted difference, which is telling us that if nothing else, the dollar is going to correct higher, potentially back towards this 108.86. Or in the alternative, I could make the argument that this is a corrective move lower in the broader up trend and the dollar is going to now resume its up trend. That is entirely possible, but we need those Fed minutes. I think first, if we see the dollar mysteriously gaining strength prior to Wednesday, excessive amount of strength, I would argue that those minutes have been potentially have been leaked.

So monitor price. But right now we know where our support is. Down right around 105.30 and the indicators and vantage point are suggesting the dollar index is going higher. Now, the main intermarket correlation in the markets right now indisputably is if the dollar is going up, stocks are going down.

S&P 500 Index

Now this past week you can see we’ve got the weekly opening price and the S&P once again, basically not making any gains really on the week at all, other than briefly on Tuesday. We could see that the S&P went up to a high of 4028, but that’s also where the 200-day moving averages on the S&P. So we’ve got the dollar index at the 200-day moving average at 105.30 approximately, and then we have approximately the 200-day `moving average around 4020. So that’s where our resistance is, and you can see the stack levels.

Now, the primary trend and the stock market is clearly indisputably down. You can see that the yearly opening price, 4778, the S&P 500 guise has never been positive on the year for any more than a couple of hours back in very, very early January of 2022. So again, when we’re looking at what the trend is, the trend is clearly down. So right now we’ve got our medium term crossing our long term predicted difference, warning us that the medium trend or the corrective move up is again, is losing momentum here.

So right now, we’ll watch this very closely. The support for this week is the TCross Long 3876. What we aim to do, or what I aim to do with these particular videos is move away from some of the short term indicators and keep our long term medium and longer term indicators on the screen so we can visually see them. If you like to use additional tools, I personally don’t, I’m not a big fan of the 200-day moving average, but the market is. So if the market believes that that particular number works, then I should respect that and say, “Okay, well these are our two levels.” In order for a bigger move up or down on stocks or the dollar. Then again, in my respectful opinion, those two levels need to, or one of the levels needs to break on either the dollar index or the S&P 500.

There is about 99% inverse correlation in these markets between these two. So not a lot of stock buyers this past week, earlier in the week. And then after that, down we go again, the Fed, Bullard coming out and again, clarifying to the market. There’s no pivot, guys, I don’t know who’s… The media can say whatever they want, but there is no pivot coming from the Fed, the exact opposite. That doesn’t bode well for stocks. So we can look at this, say our monthly opening here, price is at 3901. So it’s actually mildly positive on the month, but not by much and still firmly below that yearly opening price. So again, I believe that there will be a breakout this coming week on either the dollar or the S&P 500. But if we look at the actual primary trends on both, the dollar trend is up. The S&P is down.

The dollar usually doesn’t do very well in the month of December, but this one could buck the trend because the market is betting for some reason that the Fed is going to pivot and stop hiking, even though he has clearly stated, he’s not. And he’s also stated that he doesn’t care about the unemployment numbers, he only cares about inflation. Unemployment can be up or down, he could care less. Very interesting. I’ve never personally seen that, and it’s been probably 15, 18 years since I’ve seen the S&P 500 unable to get above, at some point during the calendar year, the S&P is unable to get above it’s yearly opening price and stay above it for even a couple of weeks or a couple of months. We don’t even have that this year, guys. It’s been down the entire calendar year. So watch this again, our TCross Long 3876. If we start losing that breaking down this week, then the primary trend is likely going to resume.

Gold

Now, when we look at gold prices here, once again, gold had a big push up with that softer CPI number, slightly softer PPI number, but nothing that would hold gains. So you can see that with using the weekly opening price here, we started to break down below that. But when we look at the neural index here, we can see that the neural index is green. But if we look at the neural index strength, you can see that it’s actually pointing down, it’s sloping down, it’s losing momentum in the market. Then ultimately, we broke under the weekly opening price, and that triggered further gold, probably just profit taking on gold. But again, the question is the US or is there going to be a global recession coming here, which usually favors gold.

But this year, I’m not convinced that gold’s going to make a lot of gains. 1829, the yearly opening price, we’re still firmly below that. Very little is changed, but a lot of this is just speculation that the Fed, but remember what the Fed said, clearly that it will take multiple months of lower inflation. That’s what it will take, multiple months. And that’s why I use the terminology. Maybe we can start to count this, but the count starts at one guys, it doesn’t start at 10 or eight because we don’t have that. So it is going to be likely several months into the first quarter before the Fed even thinks about pausing. So once again, gold is, you can see the gold buyers are getting a little nervous whenever we get close to this yearly opening price. So right now we have a very similar signal here, the MA diff cross.

This is right now, it’s a corrective move lower because we’re above the vantage point TCross Long, but the primary trend on gold right now and this year is actually down. So when we look at this, if I go back, we look at this over the nine month period, even the Russia Ukraine War couldn’t keep gold prices up, and then we broke down here in June below that yearly opening price, and we’ve just consistently made new lows here. So the theory here would be that I could definitely see gold. I would think that gold would be able to get towards the 1800 mark, but now, well, the indicators in VP are starting to roll over to the opposite side. But again, I view this as corrective while above the TCross Long. This is why I only have one predicted moving average for this presentation.

So there’s less confusion around the shorter term crossover. So right now that TCross Long 1718. One of the things I always say is that the further we move away from 1718, the more likely it is we’re going to retrace back to it. And that’s exactly what we’re doing right now. So keep an eye on that. Right now, the weekly opening price for gold is probably going to start around the week around 1750. So gold will have to maintain above 1750 to keep this bullish momentum. But the indicators in VP are saying that is unlikely.

Bitcoin

Now, when we look at Bitcoin, once again, a lot of false information being all us traders or investors is that we hear on the news every day, Bitcoin’s down 70%. See we told you it’s a scam. Remember, when they’re talking about how much something is down, shouldn’t they also be talking about how much something is up.

So yes, bitcoin is down 70% on the year, but even if we look at Bitcoin from say 2016 where it was trading at 300 bucks, 315 bucks, it’s still up 5650%. So what’s happening with FTX, this is mismanagement. It’s not the broader Bitcoin market. You’ve got the Charles Mungers of the world coming out of the woodwork here saying, “See, I told you it was a scam.” Bitcoin’s annualized returns for the last 10 years, 238% per year top investment. So that means Berkshire Hathaway and Buffet and his cronies, that means they missed the best investment over the last 10 years. That’s a little scary that somebody would come on and say, “Well, see, we told you it’s down 70%.” But well wait a minute. It’s still up 5600% from just 2016. And if you go back further than that, it’s up considerably more than that still.

So where Bitcoin goes from here, that’s left to be seen. You can see the neural index strength is very much in a cautionary stage. This is not the time of the year where Bitcoin does well anyway. So again, we will continue to monitor the developments in the crypto market. But in my respectful opinion, the media once again is spinning this with only giving you some of the facts, not all of them. So what I try to do is advocate both sides. The bull argument and the bear argument, yes, we’re down 70%, but we’re still up again 5600% since just 2016. So we remember back in the days of Apple when they had dropped considerably, almost disappeared altogether. And now look where Apple is. So it is tech, it is volatile. But right now, what in my respectful opinion Bitcoin will need is it will need the stock market to rally. Every time the S&P, the Nasdaq, the Dow has gone up, Bitcoin has gone up with it.

That’s a fact, guys, you can put the charts side by side. Bitcoin remains about 98% correlated to the S&P. Even after that, the announcement of FTX going under the S&P rallied the next day, and so did Bitcoin after they said that’s it, Bitcoin to 10,000. It rallied up to 18, 19,000 the very next day. So this is where we’ve got to look and understand intermarket correlations. When we understand that, then we can say, “Well, yeah, Bitcoin’s got some struggles ahead of it, but it’s got a very high correlation to the stock market.” So if the stock market breaks out to the upside next week, then bitcoin would go higher, not lower. But if the stock market breaks down under the 200-day moving average, gets pounded lower next week, Bitcoin will follow.

Crude Oil

Now, when we look at going into our oil contracts, once again, the oil contracts not doing overly well. And again, this could be another argument that inflation is coming down, but oil prices are normally moving in this seasonal pattern at this time, in most cases anyway, you can see it from last year. We moved down consistently until we started moving into January, and then we started moving back up. So again, I think we have to take, or we have to really be careful what media pundits we’re listening to because I don’t think they see the intermarket correlations. I don’t think they’re seeing the seasonality factor of it, but they are promoting everybody to get long stocks, stocks seasonality, stocks are going higher. The chart I’ve just shown you paints a very different picture. So when I look at oil right now, when we look at it, first of all, we’re saying that oil is normally not that strong right now anyway, but the indicators are all still pointing lower.

I would respectfully submit that we keep an eye on this neural index strength indicator because again, it can show something, the neural index can still be read, but you can see here that basically it warns us there’s potentially momentum building in the opposite direction. So that’s something we want to continue to watch. In my respectful opinion, the TCross Long 85.97. Once again, the further we move away from it, the more likely it is we’re going to retrace to it.

Euro versus U.S. Dollar

Now, as we get into some of our main pairs, once again looking at the euro from this past week, very few buyers of the euro up at these particular levels. The one thing we do have to ask ourselves, has anything changed in the Eurozone, in the UK? Is the war over, do they still have an energy crisis? Of course they do. By shutting down those coal and nuclear plants, they shot themselves in the foot everywhere here, and that’s not going to be fixed before the snow hits. So right now, reality check for the euro is what this week is likely going to be.

If the dollar advances the euro is going lower, if the dollar tanks, the euro’s going higher. But you can see that we actually finished the week virtually exactly where we started. We had a little popup there on the PPI number, and then that was quickly put to bed by Fed Mullard by saying that, “Look, we could be going to 7% here.” So right now, I think that there’s going to be… If they’re going to continue to buy the Euro, they’re going to do it very cautiously ahead of the Fed. But if there is a significant breakout on Wednesday morning or late Tuesday trade, then that could mean again, that those Fed minutes were leaked and they’re trying to get into the trade early, or they’re trying to get out of the trade before those fed minutes because they know that it’s going to be a hawkish minutes, which I suspect it will be actually. And if it is, it could be a euro killer.

So I would be prepared for the potential for a move into 1.0141. We have a newly formed verified resistance high coming in at 1.0479. So another scenario that often I see play out here is that when we start the week, we immediately push towards the previous week high and then mysteriously on Tuesday, it goes the opposite way. Be very, very careful of that because right now our neural index, our neural index strength, the MA diff cross again, is warning of dollar strength.

U.S. Dollar versus Swiss Franc

When we look at US/Swiss franc, another potential dollar long area, we see the same signal, the medium term crossing the long term predicted difference, the neural index strength showing a slightly different signal than the neural index itself breaking above the zero line, we’ve got, again, a newly formed verified zone, the yearly opening price, 0.9109. You can see how the markets springboarded off the weekly opening. My only concern is we are considerably lower from the monthly open out at the parity level, but I believe we’re going to go up and test this TCross Long at 0.9697, and that potentially will open the door back up to the parity level or above. But this pair does still show the overall depreciation of the US dollar. I’m used to trading this one guys around the 1.15, 1.20 area, even the 1.10, 1.8 1.06. So it’s still showing the depreciation of the dollar.

British Pound versus U.S. Dollar

Now the British pound this week, once again, I believe it’s too is going to struggle up here. So when we look at these levels right now, the weekly opening price, we’re just staying above it. It is doing better than the euro, but not a lot. So the verified resistance high for next week 1.2026, we would have to consistently stay above that for this to remain bullish. You can see 1.3531, the yearly opening price still in a very bearish trade formation. We can also assess the medium term crossing the long term predicted difference is even more troubling to me because again, that’s saying we’re losing momentum here. The pink line over the blue line, it measures the medium term crossover and vantage point against the long term crossover. And this is warning that we don’t have a lot of buyers up here. And when we look at how we started the week, once again, we have a very, very brief spike in the PPI number, which was not sustainable. But we did hold above. We did close above the weekly opening price. It did do better than the Euro currency, but not by much. So again, our TCross Long 1.1630, the probability of at least that area being tested next week is extremely high.

U.S. Dollar versus Japanese Yen

Now, the dollar/yen after that selloff from the previous week is now also very little to no follow through from the previous week. This is all because the media’s spinning the CPI number that now the Fed has to stop. Now the Fed has to pause and pivot. No, he doesn’t. And he;s said multiple months of lower inflation, not one, not one number, multiple months. We don’t have that. So as you can see, the dollar/yen buyers step back in. But the medium term crossing the long term predicted difference, the neural index strength crossing above the zero line after a level that has not been hit in probably 10 years, like the dollar index. When you look at overbought oversold, looking at the neural index strength, I don’t have a reading this low on the dollar index in over 10 years, 15 years. So it’s an extreme oversold condition.

I believe that potentially, so is Japan, US/Japan. So it’d be looking for a move back towards the TCross Long 143.35. Remember guys, this is still the number one carry trade out there. Long the dollar short the yen, and if the Fed continues to hike, the interest rate differential gap is going to grow bigger, not smaller. Even the Fed only hikes 25 basis points a month from here on out. It still widens that gap making the dollar very attractive against the yen.

U.S. Dollar versus Canadian Dollar

Now the Canadian dollar, once again remains in its yearly up trend. The yearly opening price, 1.26,37. Zero sellers down here right at the very start of the week here, they have a fake price, which looks bullish on the first day on Monday. We do this one in the vantage point live training room every single week, and this is what Canada does. And so it makes a bull move up. Then it sells off on Tuesday and then on Wednesday you see the real price as we start working our way back to the TCross Long. And this particular setup, again, we’re above the yearly opening price, the weekly opening price, the monthly is 1.3623, very likely that we are going to retrace to that. But we must clear the vantage point TCross Long first at 1.3447, where initially to start the week, I believe we’re going to have some sellers here, but it’s likely a fake price. Remember, the one thing I’ve always tried to teach to in the rooms and the seminars is that you have three currencies that are tied to the S&P 500, the Canadian dollar, the Aussie, and the New Zealand. Once again, is this a warning sign that the dollar is going to be the winner between the battle between the dollar and stocks?

Again, suggests that the dollar is not down and out here, right or wrong, it’s not about being right or wrong guys. It’s connecting the dots to these intermarket correlations.

Australian Dollar versus U.S. Dollar

So right now we have had zero buyers on the Aussie to begin the week, and then we end up closing below the weekly opening price. We’re below the yearly opening price at 0.7264. This is still in a very strong down trend, the monthly opening price, 0.6396. So again, if we start breaking down and we hold below the weekly opening price, the very minimum price we would likely target would be 0.6556. The same thing applies to the New Zealand, but I have argued this month, particularly with my own direct clients, that if you must buy or sell this, and in actual fact what we’ve done is we’ve looked at Aussie/New Zealand, saying the New Zealand on the seasonal basis is the stronger currency than the Aussie. So if I don’t want to trade Aussie/US and New Zealand US, I simply go over and short Aussie/New Zealand.

The month of November over the last five years, the Aussie/New Zealand pair has never closed above its opening price. It’s been bearish every single November for the last five years. That’s a seasonal pattern, guys, an exponential seasonal pattern that tells me that.

New Zealand Dollar versus U.S. Dollar

So instead of going after longs on Aussie/US or longs on New Zealand/US, I can take the safer bet and just short Aussie/New Zealand without the exposure, direct exposure to the US dollar. So just another way to play that. But again, we are going to have another volatile week with those Fed minutes, and I do suspect there will be a breakout on the dollar or the S&P 500 coming next week. So with that said, this is the VantagePoint AI Market Outlook for the week of November, the 21st, 2022.

Improve your stock trading with our award-winning Black Friday 2022 deals, featuring stunning 65% discounts on TradingView, Trade Ideas, Stock Rover, MetaStock, FinViz, Benzinga Pro, TrendSpider, and more.

Black Friday & Cyber Week is by far the best stock market software sale of the year

As a stock trader or investor, Black Friday and Cyber Monday are the best time to renew your stock market software subscription or even try a new service. Grab a bargain with our selection of the best trading software and hot deals this week.

Count down to Black Friday!

All Black Friday/Cyber Discounts Below Are Updated Daily. Most Deals Go Live On Black Friday, November 25, 2022, But Some Deals Have Already Started – Check Below.

| Black Friday Deal | Discount Details |

TradingView |

Our test winner for best US & international stock, crypto and forex trading software, social network, live trading & backtesting.

TradingView Black Friday -60% Deal Starts In: ✅ Applies to New Customers |

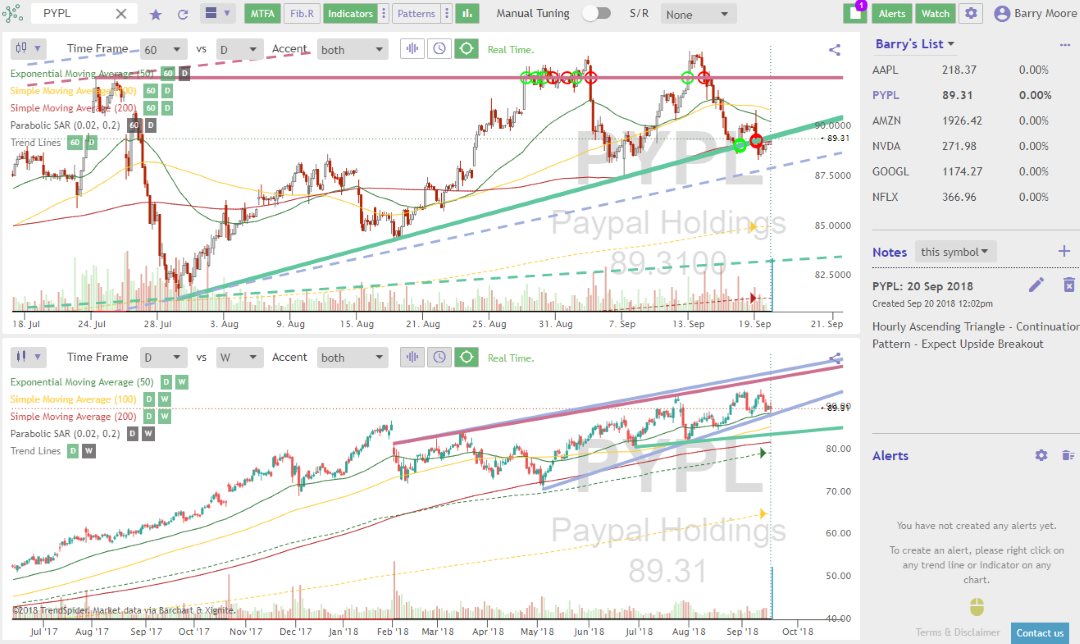

TrendSpider |

The leading automated stock chart analysis software with trend & pattern recognition, plus powerful backtesting for US stocks and crypto.

TrendSpider Black Friday -65% Deal Is Live – Ends In: ✅ Applies to New Customers |

Pro Training Courses-50% Discount Live Now |

Invest in yourself! Get all our courses & strategies for 50% off

★ Liberated Stock Trader Pro Stock Investing & Trading Course ★ 108 Videos + 3 Full eBooks + 5 Scripts for TradingView + Code & Logic For Stock Rover All Star Pass Black Friday -50% Deal Is Live – Ends In: |

Stock Rover |

The best stock financial analysis, research, screening, and portfolio management software for US growth, income & value investors.

Stock Rover Black Friday -30% Deal Starts In: ✅ Applies to New Customers |

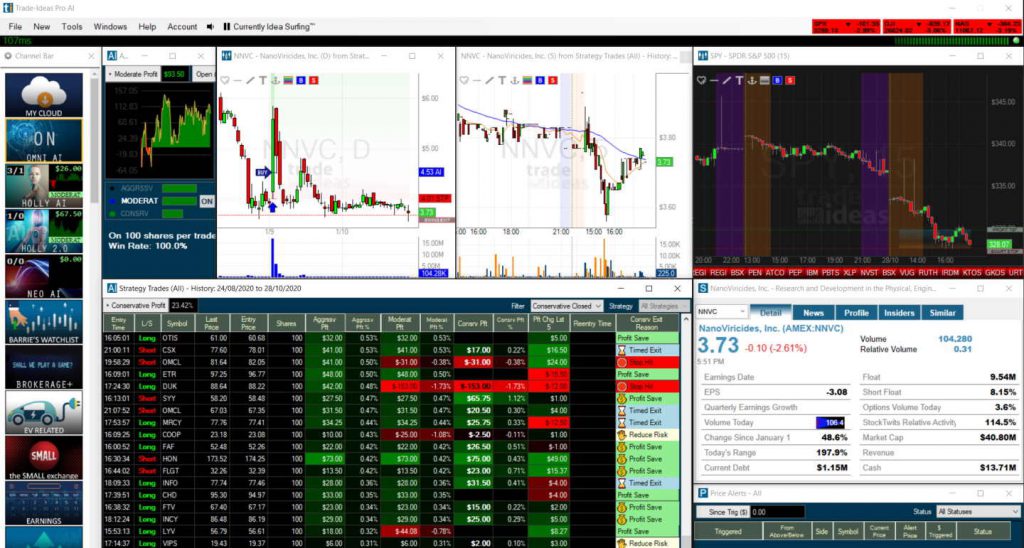

Trade Ideas |

Our winner for best AI day trader stock software, with a powerful prediction engine and auto-trading bots, for US day traders.

Trade Ideas Black Friday -30% Deal Starts In: ✅ Applies to New Customers |

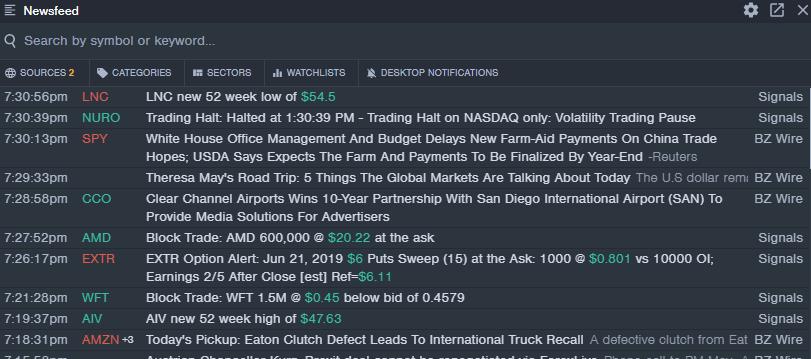

Benzinga Pro |

The best US real-time news, research & analysis software for stock traders.

Benzinga Black Friday -35% Deal Starts In: ✅ Applies to New Customers |

MetaStock |

The best stock program for chart analysis, backtesting, forecasting & real-time global financial news.

MetaStock Black Friday -20% Deal Starts In: ✅ Applies to New Customers |

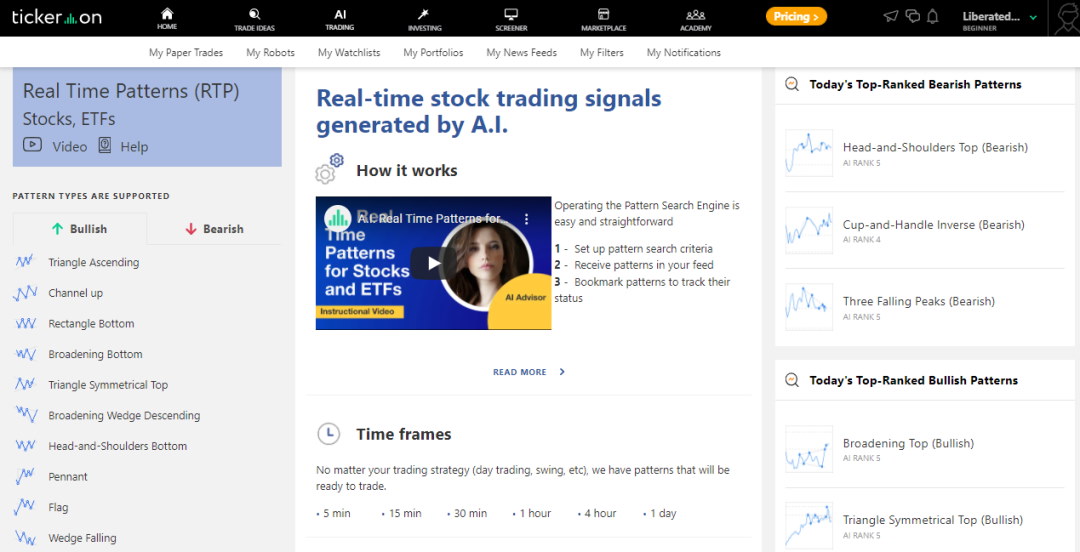

Tickeron |

Tickeron’s selection of AI bots & trading signals for traders is excellent.

✅ Applies to New Customers |

finviz |

The fastest free and premium stock screener, with heatmaps, charts, and real-time data.

✅ Applies to New Customers |

We independently research and recommend the best products. We also work with partners to negotiate discounts for you and may earn a small fee through our links.

TradingView is an easy-to-use, powerful platform that supports all international stock markets. TradingView is designed for traders who value a great price, powerful chart analysis, backtesting, and a large social community.

| TradingView Highlights | Details |

| ⚡ Features | Charts, Trading, News, Watchlists, Screening |

| 🏆 Unique Features | 10 Million User Community, Backtesting |

| 🎯 Best for | Stock, Fx & Crypto Traders |

| 🎮 Premium Trial | Free 30-Day |

| ✂ Premium Discount | -50% Discount |

| 💰 Price | $0-$59/mo |

| 🌎 Markets Covered | Global |

✓ Great Technical Analysis Charts

✓ Social First, Chat, Publish, Follow

✓ Good Backtesting & Screening

✓ Easy to use

✓ Crypto, Forex, Stocks Globally

✘ No Real-time News

✘ Watchlist Customization

TradingView Black Friday -60% Deal Starts In:

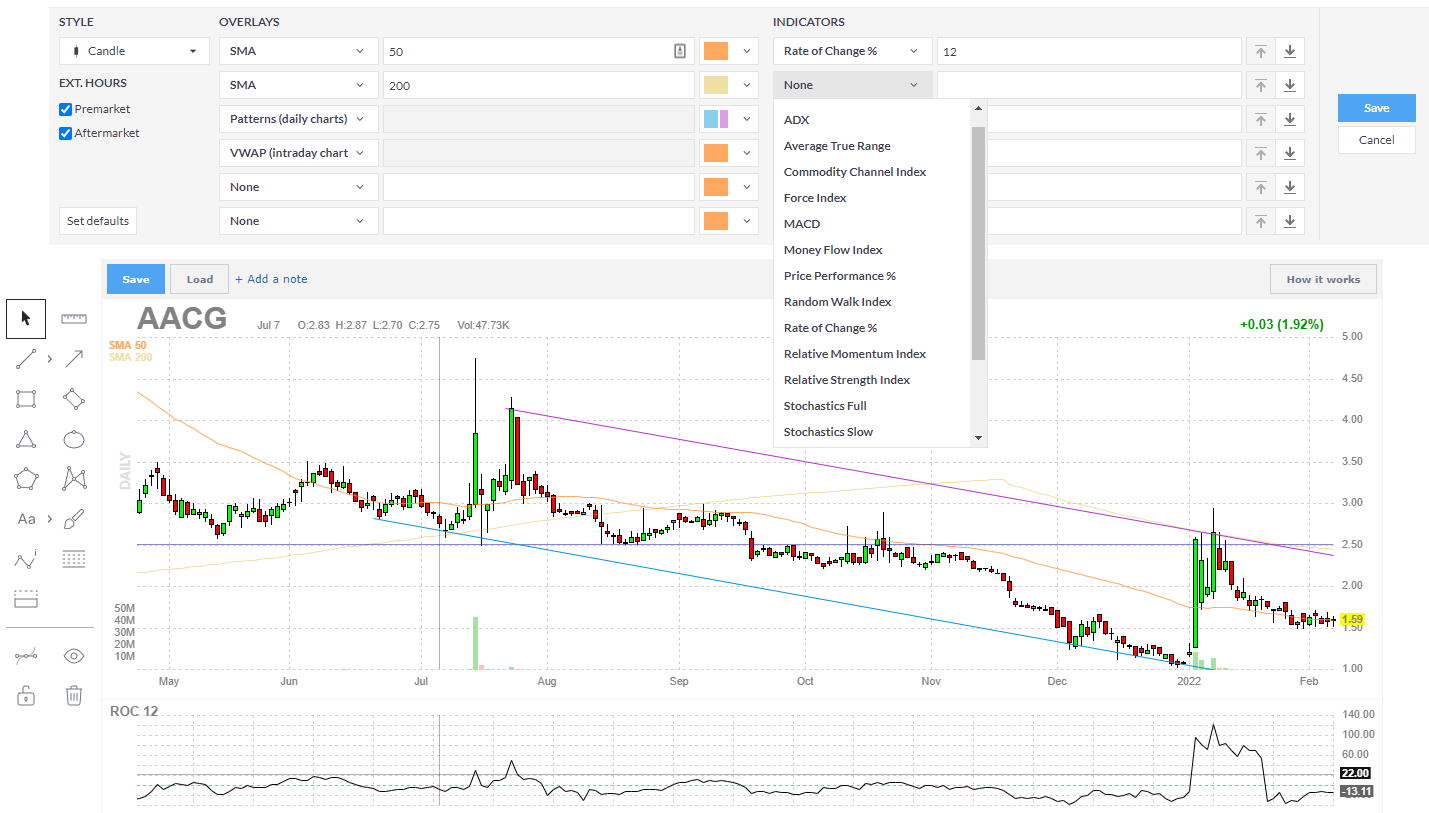

TradingView has an active community of people developing and selling stock analysis systems, and you can create and sell your own with the Premium-level service. Also, there are many indicators and systems from the community for free.

TradingView has over 160 stock chart indicators and unique charts such as LineBreak Charts, Kagi Charts, Heikin Ashi, Point & Figure Charts, and Renko Charts. As an advanced technical trader, you will be well served.

TradingView has over 250 criteria for scanning and screening stocks, Forex, and Cryptocurrencies. There are 48 different fundamental criteria and 96 technical variables available. TradingView also includes 48 economic indicators available through the Federal Reserve Database (FRED), including the Federal Funds Rates and World Economic Growth.

I have implemented my MOSES (Market Outperforming Stock ETF Strategy) into TradingView. TradingView enables you to create any system or strategy using Pine script easily. Below you can see 3 MOSES Strategies compared with the equity curve. This MOSES system beat the NASDAQ 100 by 100% over the past 24 years.

TrendSpider is best for all traders seeking cutting-edge AI software that automates technical chart analysis, trendline & pattern recognition. TrendSpider has robust system backtesting and automated Fibonacci & Candlestick recognition covering Stocks, ETFs, Fx & Crypto Markets.

| TrendSpider Highlights | Details |

| ⚡ Features | Charts, Watchlists, Multi-timeframe Analysis, Backtesting |

| 🏆 Unique Features | Automated Trendlines, Fibonacci, and Candlestick Pattern Recognition |

| 🎯 Best for | US Stock, Forex & Crypto Traders |

| 🆓 Free Version | No |

| 🎮 Premium Trial | Free 7-Day |

| ✂ Premium Discount | -40% Use Coupon Code “LIB40” |

| 💰 Price | $27-$69/mo |

| 🌎 Markets Covered | USA |

✓ Automated Trendline & Fibonacci Detection

✓ Automatic Multi-Timeframe Analysis

✓ Code Free Backtesting

✓ Real-time Data Included

✓ Stocks, ETFs, Fx, Crypto, Futures

✘ No Social

✘ No Auto Trading

The TrendSpider team is innovating at breakneck speed, and the features they are innovating are unique to the industry, with trendline automation, pattern recognition, and multi-timeframe analysis.

TrendSpider Black Friday/Cyber Week Deal is Live Now

☆ Up to 65% Off Advanced plans ☆

☆ Up to 55% Off Elite plans ☆

☆ Up to 50% Off Premium plans ☆

It’s their biggest sale of the year, available for renewals or new registrations.

TrendSpider Black Friday -65% Deal Is Live – Ends In:

Packed with innovative technical analysis tools, TrendSpider is a leading stock charting software. If you are a serious market analyst, then TrendSpider will help you do the job quicker, with better quality, and help you not to miss an opportunity.

Automated trendline detection and plotting do a better job than a human can; using algorithms, the system can detect thousands of trends-lines and flag the most important ones with the highest backtested probability of success.

The automated trendline & candlestick detection and recognition do a better job than any human

TrendSpider’s multi-time-frame analysis means viewing multiple time-frame charts on a single chart with the trendlines plotted automatically. Another great feature is the advanced plotting of support and resistance lines into a subtlely integrated chart heatmap.

TrendSpider has three big benefits:

Stock Rover is ideal for USA Value, Dividend & Growth investors seeking innovative fundamental stock analysis, screening, and portfolio management software. Stock Rover enables the easy implementation of powerful investing strategies.

| Stock Rover Highlights | Details |

| ⚡ Features | Charts, Powerful Screening, Research, Broker Integration |

| 🏆 Unique Features | 10-Year Historical Financial Data, Full Portfolio Mgt, Correlation, Rebalancing & Value Investing Benefits |

| 🎯 Best for | Growth, Dividend & Value Investors |

| 🆓 Free Version | Stock Rover Free |

| 🎮 Premium Trial | Free 14-Day |

| ✂ Premium Discount | 25% During Trial Period |

| 💰 Price | $0-$27/mo |

| 🌎 Markets Covered | USA |

✓ 10-Year Financial Data

✓ Best Screening Criteria

✓ Stock Scoring & Ratings

✓ Value, Dividend & Growth Screeners

✓ Easy to use

✘ No Social Community

✘ No Real-time Charts

Stock Rover Black Friday -30% Deal Starts In:

Stock Rover is best at screening for stocks to build professional growth, dividend, and value stock portfolios. Stock Rover provides detailed research reports, historical screening, portfolio management reporting, rebalancing, and correlation.

If you manage your portfolio of stocks with multiple brokers, Stock Rover will also integrate them into one view.

Stock Rover is not for day traders; it is for long-term investors that want to maximize their portfolio income and take advantage of compounding and margin of safety to manage a safe and secure portfolio.

Stock Rover scores perfectly in our screener testing, offering the most detailed stock and ETF financial data. Stock Rover has over 600 data points and historical data stretching back ten years, enabling you to backtest fundamental strategies. Stock Rover also has a unique Margin of Safety, Fair Value, and Discounted Cash Flow data to help you invest, like Warren Buffett. Add the exclusive stock scoring systems, and Stock Rover is the best stock screener for the North American markets.

I do not say this lightly. If you are a long-term US Investor, Stock Rover is the best & only software you ever need.

Trade Ideas is best for active day traders wanting AI-driven trading signals. Trade Ideas provides actual buy & sell signals for trades by performing millions of backtests per day on 70+ strategies. The Holly AI platform has an audited track record of beating the market.

| Trade Ideas Highlights | Details |

| ⚡ Features | Charts, Scanning, Broker Integration, Trading Room |

| 🏆 Unique Features | AI Trade Signals, Auto-trading, Proven Profitable Track Record |

| 🎯 Best for | US Day Traders |

| 🆓 Free Version | No |

| 🎮 Premium Trial | Try the Trading Room for Free |

| ✂ Premium Discount | -15% Discount Code “Liberated” |

| 💰 Price | $118-$228/mo |

| 🌎 Markets Covered | USA |

Trade Ideas Black Friday -30% Deal Starts In:

✓ 3 AI Trading Algorithms

✓ Market-Beating Audited Performance

✓ Exceptional Stock Scanning

✓ Real-time Trade Signals

✓ Auto-trading With AI Signals

✓ Free Live Trading Room Access

✘ User Interface

✘ Takes Time To Learn

✘ Choice of Indicators

According to our testing, Trade Ideas is the industry-leading artificial intelligence-powered stock market scanning and trading signals generation platform. Despite a complicated user interface, the real power lies underneath with 30 channels of trading ideas & three AI systems pinpointing trading signals for day traders. Trade Ideas promises and delivers the nirvana of market-beating returns.

Trade Ideas is unique because the software tells you when to buy and sell stocks by analyzing millions of trade setups daily. The analysis results in 3 to 5 high probability trades every day.

Trade Ideas Standard costs $118 per month, or you can save $348 by going for an annual subscription costing $1068, a 25% discount. Standard includes a live trading room, streaming trade ideas, ten chart windows, trading from charts, and 500 price alerts.

Trade Ideas Premium costs significantly more than Standard service at $228 per month. You can save $468 by going for an annual subscription costing $2268. Premium provides the three Holly AI Systems, specific real-time trade signals, risk assessment, full backtesting, and integrated auto-trading.

Trade Ideas Premium features include:

Trade Ideas is the most expensive software in this review because it offers the real possibility of beating the market using AI pattern recognition and establishing a trading bot to auto-trade on your behalf.

Trade Ideas, unlike any other software, does all the work for you providing you specific market beating AI trading Signals, to help you make regular profits.

Extensive testing reveals that Trade Ideas is an incredibly powerful stock trading desktop app that seamlessly integrates cloud-based AI algorithmic stock signals to provide high-probability day trading opportunities.

When you first open Trade Ideas on your desktop, the software feels clunky and not user-friendly. Every chart and table is in a separate window, so if you want to resize the view, you need to resize all eight windows. This seems such a hassle initially and seems to hark back to the age of Windows 98.

There is a good reason for this design; you have endless flexibility and window configuration options if you operate multiple monitors and large screens. Even though they are fully separate windows, they can be linked and unlinked together to provide a more fluid experience with some practice.

So although it is clunky and some of the most important functions are hidden behind right-click menus in certain windows, you start to get used to the design after a few hours.

Benzinga Pro is a unique stock program for trading real-time stock news. Designed for day traders, Benzinga Pro delivers real-time market-moving news to give you a trading edge. Additionally, a news squawk box, direct access to the news desk, and real-time charting and scanning complete the service.

| Benzinga Pro Highlights | Details |

| ⚡ Features | Real-time News, Calendar, Charts, Screening |

| 🏆 Unique Features | Stock & Options Squawk Box, News Sentiment, News Rating, Options Alerts |

| 🎯 Best for | US Stock, Fx, Commodity & Bond Traders |

| 🆓 Free Version | No |

| 🎮 Premium Trial | 14 Day Free |

| ✂ Premium Discount | -25% Code “SMARTER” |

| 💰 Price | $79-$117/mo |

| 🌎 Markets Covered | North America |

Benzinga Black Friday -35% Deal Starts In:

✓ Best Real-time Stock Market News

✓ Squawk Box Live Feed

✓ Real-time Alerts & Signals

✓ Good Charts & Screening

✘ North America Only

✘ No Broker Integration

Benzinga PRO costs $79 per month for the Basic Plan, which gives you real-time newsfeeds and watchlist alerts. Benzinga Pro Essential costs $117 per month, adding the Squawk Box, Calendars, Sentiment Indicators, and the Chat with Newsdesk functionality.

The stock program is stable and elegant, allowing you to set up multiple workspaces and monitors to suit your needs. Benzinga is also constantly adding new functionality, and it is a platform that should grow with your needs.

Benzinga Pro is the best for scanning and screening the news, but it can also screen for technical and fundamental data. Benzinga Pro has 32 fundamental screening criteria, including P/E, PEG, Profitability, Margins, and Insider Ownership. There are also 23 market scanning criteria, including volume change, relative volume, and short interest.

Core to the Benzinga Pro service is access to the real-time newsfeed, which updates quickly and effectively. The only news excluded in the basic package is the Securities & Exchange Commission (SEC) announcements and Public Relations (PR) newsfeeds.

MetaStock is best for stock traders who need real-time news, access to a huge stock systems marketplace, and the best technical stock chart analysis, backtesting, and forecasting. All international exchanges are covered & backed up with excellent customer service.

| MetaStock Highlights | Details |

| ⚡ Features | Charts, Watchlists, Scanning, Backtesting |

| 🏆 Unique Features | Forecasting, Real-time Global Trading News (Multi-language) |

| 🎯 Best for | Stock, Fx & Commodity Traders |

| 🆓 Free Version | No |

| 🎮 Premium Trial | 30-Day Free Trial |

| ✂ Premium Discount | 3 Months for 1 |

| 💰 Price | $59-$250/mo |

| 🌎 Markets Covered | Global |

MetaStock Black Friday -20% Deal Starts In:

✓ Best Stock Backtesting

✓ Largest Selection of Charts & Indicators

✓ Real-time Global News

✓ Stock Forecasting

✓ All International Stock Exchanges

✘ PC Only/No Mobile App

✘ No Broker Integration

✘ Poor Interface

The latest release of Metastock is a big hit with improvements across the board. Considerable advances in scanning, backtesting, and forecasting make this one of the best offerings on the market.

Using MetaStock R/T, you can see an incredibly in-depth analysis of company fundamentals from debt structure to top ten investors, including level II. Excellent watchlists featuring company financials and powerful scanning of the markets make MetaStock unique.

MetaStock R/T Refinitiv integration means you get institutional quality real-time news, analysis, research, and economic outlooks. Refinitiv is the fastest global news service available in the industry. For international investors, MetaStock is unique because the news is also translated into all major languages.

MetaStock has over 350 stock tools for charting, annotation, and drawing trendlines and indicators, the broadest selection of technical analysis tools on the market today. MetaStock is the clear leader in pure technical analysis of stock charts; it includes Point & Figure and Market Profile Charts, meaning it has the best stock trading charts.

Innovative additions to MetaStock, like Foreign Exchange forecasting based on market sentiment, are exceptional. This makes MetaStock our recommendation for the best technical chart analysis software.

Another area where MetaStock excels is what they call “Expert Advisors.” MetaStock harnesses many inbuilt systems to help you understand and profit from technical analysis patterns and well-researched systems. This is a unique differentiator from the competition. The most significant addition to the MetaStock arsenal is the forecasting functionality, which sets it apart from the crowd.

MetaStock has over 100 computerized stock market systems called Expert Advisors. These programs scan stock charts for a system’s targeted conditions. The Expert Advisor systems, either in-built or as 3rd part add-ons, will help you understand and profit from technical analysis patterns in price and volume. This is a unique differentiator from the competition.

The most significant MetaStock innovation is the forecasting functionality, which does not exist with any other software. By selecting Forecaster from the power console, you can simply choose one or more stocks, ETFs, or Forex pairs and click forecast. You are then presented with an interactive report which enables you to scan through the many predictive recognizers, which help you understand the basis for the prediction and the methodology.

Tickeron has impressive AI-powered chart pattern recognition and prediction algorithms for stocks, ETFs, Forex, and Cryptocurrencies. Tickeron excels at providing thematic model portfolios and specific pattern-based trading signals combined with success probability and AI confidence levels.

| Tickeron Highlights | Details |

| ⚡ Features | Portfolios, Watchlists, Screening |

| 🏆 Unique Features | AI Trade Signals, AI Portfolios & AI Pattern Recognition |

| 🎯 Best for | Traders & Investors Using AI Trading |

| 🆓 Free Version | Yes |

| 🎮 Premium Trial | 14-Day Free Trial |

| ✂ Premium Discount | 50% Off All Annual Plans |

| 💰 Price | $0-$250/mo |

| 🌎 Markets Covered | USA |

Count down to Black Friday!

✓ 45 Streams of Trade Ideas

✓ 40 Chart Patterns Recognized

✓ AI Trend Prediction Algorithms

✓ Audited Performance Track Records

✓ Build AI Portfolios

✘ Custom Charting Limited

✘ Cannot Plot Indicators

Tickeron’s trading platform is unique and innovative, combining artificial intelligence and human intelligence based on the community of traders, so you can compare what the humans think versus the machines.

Tickeron targets day traders, swing traders, and investors with intricate features and benefits specific to your investing style.

Tickeron is a wholly-owned subsidiary of SAS Global, a leader in data analytics whose services are used by the majority of fortune 500 companies. Tickeron uses AI rules to generate trading ideas based on pattern recognition. Firstly they use a database of technical analysis patterns to search the stock market for stocks that match those price patterns using their pattern search engine. Of course, each detected pattern has a backtested track record of success, and this pattern’s success is factored into the prediction using their Trend Prediction Engine.

At the heart of Tickeron is the ability of its AI algorithms to spot 40 different stock chart patterns in real time. You can select which pattern you want to trade, and it will filter stocks, forex, or cryptocurrencies that currently show the pattern. Patterns are split into bullish patterns for long trades or bearish patterns for those who wish to go short.

Tickeron’s real-time pattern recognition is particularly useful for swing or day traders, where market timing is the top priority. Tickeron also can scan the entire market and suggest which patterns are working best on a particular day. In the screenshot above, you can see “Today’s Top Ranked Patterns,” which rates the potential success of the patterns based on the market’s current trading activity.

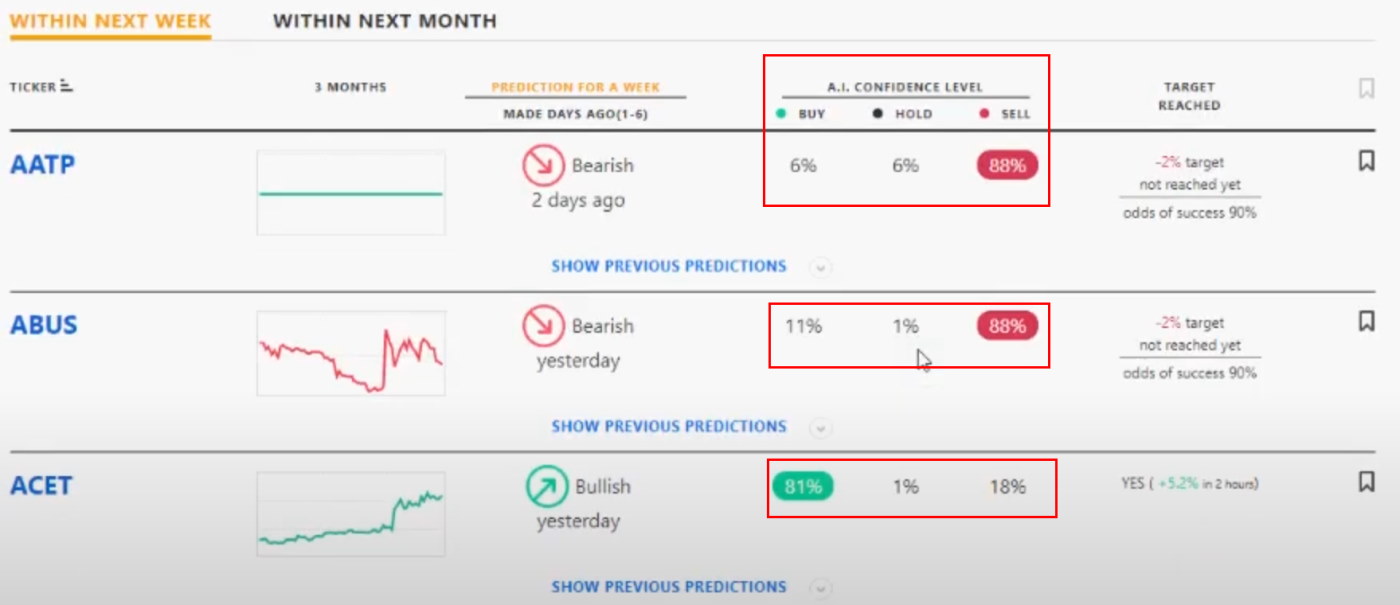

Tickeron has implemented a powerful feature called AI Confidence level. Based on the history of the stock, the success rate of a particular pattern, and the market’s current direction, Tickeron can assign a confidence level to a trade prediction.

The screenshot below shows that the Tickeron AI predicts that ABUS has an 88% chance of declining in value and ACET has an 81% chance of increasing in value.

The outstanding feature of the Tickeron prediction engine is that you can simply click “Show previous predictions” to check if the Ai has done a good job in the past with a particular pattern on specific stocks. The prediction engine provides the right level of clarity and granularity so you can make informed trading decisions.

Finviz provides lightning-fast free stock charting, robust screening, and stock chart pattern recognition. Finviz lets investors visualize a vast amount of stock market data with heatmaps and money flows on a single screen.

| Finviz Highlights | Details |

| ⚡ Free Features | Charts, News, Watchlists, 50 Screener Configs, Heatmaps [Ad-supported] |

| 🏆 Premium Features | Real-time data, Alerts, Correlation Charts, Backtesting, Data Export, 8 years of Financial Statements |

| 🎯 Best for | Beginner Investors/Traders |

| 🆓 Free Version | Finviz Free |

| 🎮 Premium Trial | 30-Day Money-Back |

| ✂ Premium Discount | -37% With Annual Plan |

| 🌎 Markets Covered | USA |

Count down to Black Friday!

Finviz has three pricing plans; the Free plan is free to use without registering. Registered users can also use the service for free and save their settings. Finally, the Elite service costs $39.99/mo or $24.96/mo on an annual plan, saving you 37%.

You can have Finviz for free; however, the real power of Finviz is unleashed with the Elite service, which provides real-time data and maximum flexibility.

Finviz’s free plan is ad-supported, but it provides a huge amount of value for beginner investors. You can scan and screen over 10,000 stocks without registering and use the delayed charts and news stream. The free plan is ideal for beginner investors who want to check the markets fuss-free.

If you like Finviz, I highly recommend registering for free because it provides all the free version features. You can also configure 50 portfolios, 50 stocks per portfolio, and save 50 screener configurations.

The Finviz heatmaps are the star of the show, providing a view of the US or even the entire world’s stock markets. Finviz manages to cram the entire world’s moving stocks onto a single-page heatmap at lightning speed, which is very impressive. Simply hovering your mouse over a ticker symbol shows the stock’s current performance, a mini line chart, and the company’s direct competitors.

Interestingly viewing the Finviz stocks heatmaps based on analyst recommendations shows how biased institutional analysts are, as 70% of stocks are flagged as positive.

Finviz allows you to visualize markets based on stock price performance, volume, P/E, PEG, Dividend Yield, Float, EPS, and even analyst recommendations. From here, Finviz allows you to double-click on stock and jump directly to the individual company data and chart. The whole process is extremely fast and efficient.

Looking at stock charts with Finviz is different from the other stock software products on the market. Whereas MetaStock & TradingView provide hundreds of fundamental technical analysis indicators, Finviz focuses on basic pattern recognition on daily charts and a small handful of overlays and indicators.

I like the Finviz automatic trendline recognition and how it identifies price patterns like wedges, triangles, double tops, and channels; this is a big advantage for pattern traders.

With 9 chart overlays, including Bollinger Bands and VWAP, and 17 chart indicators, the stock charting experience with Finviz is ok.

The Finviz service is worth using, with excellent heatmaps, free global stock screening service, good news aggregation, and insider trading information. What more do you expect for free? Finviz provides fast stock screening, heatmaps, and stock chart pattern recognition for free. If you want to visualize a large amount of stock data and find investments quickly, Finviz is definitely worth it.

My testing of Portfolio123 shows impressive stock screening, software with a robust financial database, and integrated commission-free trading with Tradier. Portfolio123 can be used by income, value, and growth investors but is also advantageous for swing traders.

| Portfolio 123 Highlights | Details |

| ⚡ Features | Screening, Research, Powerful Backtesting |

| 🏆 Unique Features | Free $0 Integrated Trading, 10-Year Financial Database |

| 🎯 Best for | Stock & Options Traders |

| 🆓 Free Version | No |

| 🎮 Premium Trial | 21 Days for $9 |

| ✂ Premium Discount | None |

| 💰 Price | $0-$83/mo |

| 🌎 Markets Covered | USA/Canada |

Count down to Black Friday!

✓ 470+ Screening Metrics

✓ 10-Year Backtesting Engine

✓ Pre-built Model Screeners

✓ 260 Financial Ratios

✓ Integrated Free Trading

✘ No Integrated News

✘ No App for Android or iPhone

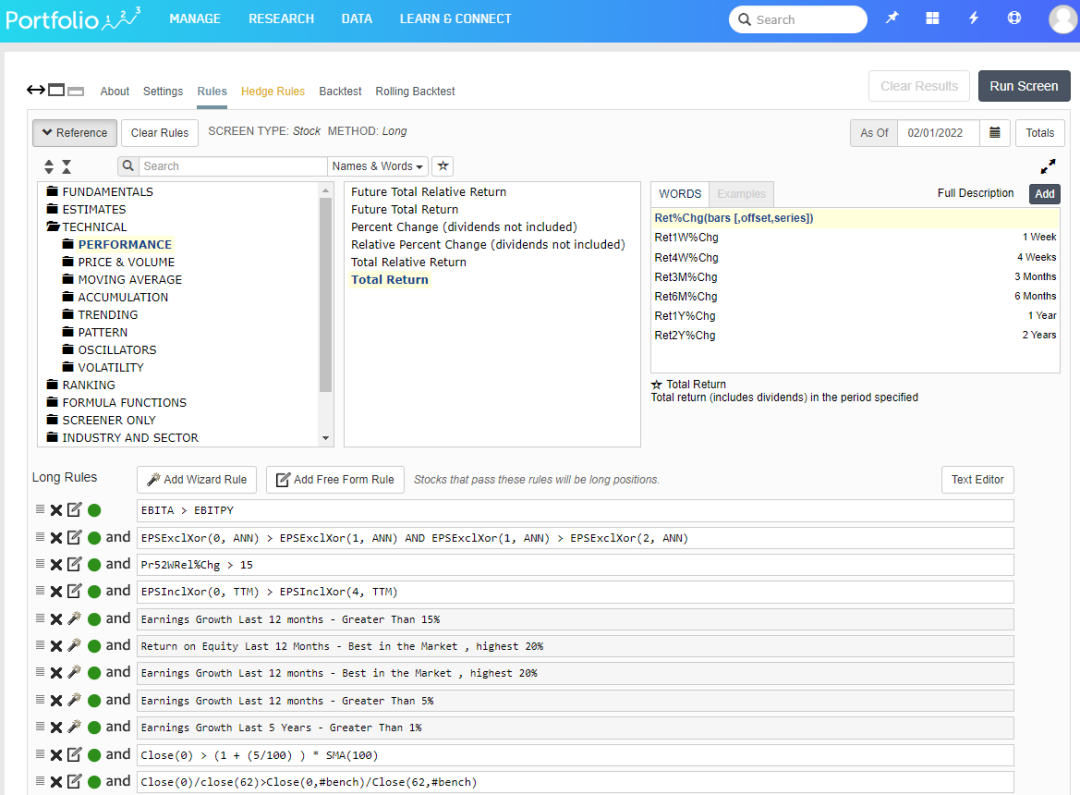

Portfolio123 covers stocks, fixed income, and ETFs on US & Canadian exchanges, so it is unsuitable for international stock investors. With Portfolio123, you can design a real-time trading strategy, fully automated with a broker, that will hold the stocks that pass your screen and sell those that don’t.

Most ideas based on fundamentals will be covered with over 225 data points. Portfolio123 has 460 criteria, including analyst revisions, estimates, and technical data.

You can also use Portfolio123 to screen stocks on their performance relative to the S&P500 or any other benchmark. You could develop a strategy to select stocks based on their historical performance versus the market.

The number of factors available for screening is impressive. Not only can you screen based on reliable information from a company’s financial reports, but you can access technical factors, create your factors using period and announcement dates, eliminate stocks with high bid-ask spreads, limit your screen to stocks in a certain industry, or sector, rank factors against other stocks in an industry or sector, and change your factor balance depending on economic conditions.

Building your Portfolio123 screener is theoretically easy; select Research -> Screens, and you can start to play. No programming skills are required to build a Portfolio123 screener, but basic coding will certainly help. If you want to create more powerful screening rules, you will need to study the coding logic and understand the proprietary criteria names.

PM Modi speaking at the 2014 Global Citizen Festival in New York’s Central Park. (File)

New Delhi:

Prime Minister Narendra Modi was given the same kind of protection from prosecution in the US that was recently afforded to Saudi Crown Prince Mohammed bin Salman, a US State Department spokesperson said in a briefing on Friday.

Pressed about granting immunity to the crown prince over the brutal killing of journalist Jamal Khashoggi in which he is an accused, US State Department Principal Deputy Spokesperson Vedant Patel said PM Modi was among those who had received similar protection.

“This is not the first time that the United States has done this. It is a longstanding and consistent line of effort. It has been applied to a number of heads of state previously,” Mr Patel told a journalist.

“Some examples: President Aristide in Haiti in 1993, President Mugabe in Zimbabwe in 2001, Prime Minister Modi in India in 2014, and President Kabila in the DRC in 2018. This is a consistent practice that we have afforded to heads of state, heads of government, and foreign ministers,” he said.

India is yet to comment on the remarks.

The US had placed PM Modi on a visa ban in 2005 over allegations that his government did nothing to stop the 2002 riots in Gujarat as Chief Minister.

Until his election as Prime Minister in 2014, the US maintained that there is “no change in its policy”, even after the United Kingdom and the European Union ended their boycott.

PM Modi has been cleared of any wrongdoing by investigations into the Gujarat riots. Earlier this year, the Supreme Court rejected an appeal against his exoneration in one of the cases linked to the killings.

Over 1,000 people were killed in the three-day violence in Gujarat in 2002 and the state police faced grave charges of not doing enough to stop the riots that began after a train coach carrying pilgrims was burnt in Godhra, killing 59 people.

Insider trading is the act of trading in the stock of a publicly traded firm by a person who, for any reason, possesses non-public, material knowledge about that stock. Based on the period the insider executes the trade, insider trading may be either legal or illegal.

When the relevant information is still private, insider trading is prohibited and is subject to severe penalties.

KEY LESSONS

The purchasing or trading of a security “in violation of a fiduciary responsibility or other relations of faith and credibility, on the basis of substantial, private data about the security,” according to the Securities and Exchange Commission (SEC) of the United States.

Any data that could significantly affect a buyer or seller of a securities is considered material information. Information that is not legally accessible to the public is considered non-public information.

The effort of the SEC to keep a fair marketplace exists at the root of the legality issue. A person with access to insider knowledge will have an unfair advantage over other shareholders who lack that access and might potentially generate higher, unfair gains than their partner investors.

When you share any kind of significant nonpublic knowledge with others, you are engaging in illegal insider trading. When chief executives buy or sell shares, but legally declare their transactions, this is referred to as lawful insider trading. Regulations set forth by the Securities and Exchange Commission guard investments against the consequences of insider trading. Whether the individual is an employee of the corporation or not has no bearing on how the critical nonpublic information was obtained.

Assume, for instance, that someone discusses nonpublic material information with a friend after learning about it from a member of the family. All three parties involved may face legal action if the buddy takes advantage of this insider data to make money in the stock market.

Insiders are defined as “management, officers, or any controlling shareholders with far more than 10% category of a company’s securities” by the U.S. Securities and Exchange Commission (SEC).

Insiders are subject to regulations, which include submitting SEC forms each time they acquire or sell shares. The rule also prohibits insiders from depositing shares in under six months of their transaction in order to avoid insider trading, which is when people have illegal access to significant non-public information because of their holdings.

This essentially prevents insiders from making money off of quick swing trades using their inside information.

In general, insider buying is viewed as a bullish indicator because it demonstrates management’s belief in the company. In other statements, insiders predict an increase in the value of their stock. Insider selling is viewed negatively; those with knowledge may be unloading their stock in anticipation of a quick decline in share prices.

Insider purchases outperformed the market by 11.2% annually, according to a large survey by Yale University’s Andrew Metrick, Richard Zeckhauser, and Leslie A. Jeng of Harvard University. Insider sales, interestingly, were not as profitable.

Because of this, numerous investors monitor insiders’ activities.

Insider trading is typically associated with bad things. Weekly legal insider trading takes place on the stock market. The SEC mandates that transactions be promptly filed electronically. The SEC receives electronic transactions, which must also be declared on the firm website.

The Securities Exchange Act of 1934 marked the beginning of the legal disclosure of stock-related transactions. Directors and significant stockholders are required to report their holdings, transactions, and ownership changes.

Due to the notion that it is unethical to the typical investor, the word “insider trading” often carries a negative sense. Insider trading basically refers to the act of someone who knows meaningful, non-public knowledge about a stock of a publicly traded corporation trading in that stock. Based upon what insider trading complies with SEC regulations, it may be permissible or criminal.

When the relevant knowledge is still secret, insider trading is believed to be unlawful and is subject to severe penalties, including possible penalties and fines. Any nonpublic data that could materially affect the company’s stock price is referred to as insider information. Naturally, having access to such knowledge could impact an investor’s choice to buy or sell the security, giving them a competitive advantage over the general public who do not. ImClone trading by Martha Stewart in 2001 is a good illustration of this.

Weekly legal insider trading takes place on the share market. The effort of the SEC to keep a fair marketplace exists at the root of the legality issue. Essentially, as far as they notify the SEC of these trades promptly, it is permissible for corporate insiders to trade company shares. The Securities Exchange Act of 1934 marked the beginning of the legal reporting of stock-related transactions. Directors and significant stockholders, for instance, are required to report their holdings, transactions, and ownership changes.

Insiders are defined as “management, officers, or any controlling shareholders with over than 10% category of a company’s securities” by the U.S. Securities and Exchange Commission (SEC).

Insiders are subject to regulations, which include submitting SEC forms each time they acquire or sell shares. The rule also prohibits insiders from depositing shares in under six months after purchase in order to avoid insider trading, which is when people have unauthorized entry to substantial non-public information because of their positions.

Insider Trading needs a lot of insider information that couldn’t be available easily. Our Spiking Race to 100 helps you reach that information in just one click. You can access the winnings and all the insider details to make your investment decisions.

Spiking Race to 100

We are extremely excited to announce we have a new product called Race to 100. You can track the best investors who have made more than 100% profit in a year and replicate their portfolios in just a few clicks. Be the first to learn these top investors’ new trades and trade alongside the shoulders of the giants. Try Race to hundred now at spiking.com/race!

Want to learn more about the various trading strategies and see which one suits you the best? Led by Dr. Clemen Chiang, the Spiking Wealth Community is an online community network. Together we are catching the Spikes so that you have faith, hope, and love in everything you do. Spiking Wealth Community helps you to accomplish time squeeze by connecting the dots through online courses, live trading, winning trades, and more. Join us for Free and start your Spiking Wealth Journey today!

*