Here is a consolidated list of the best cryptocurrency exchanges with my comments:

| Name of the Exchange | CoinSutra Comments | Overall CoinSutra Rating | No. of Trading Pairs |

|---|---|---|---|

| Binance | • It offers a mobile app and the world’s largest exchange.

• If you need to pick only one, this is the best and #1 in 2022. • It offers max number of crypto pairs, basic and advanced trading. • A lot of exciting features, including Margin trading, Exchange coin (BNB), and many more |

9.8/10 | 1292 |

| Huobi Global | • One of the largest exchanges of the crypto market

• High security and great customer support |

910 | |

| Changelly | • Instantly convert any cryptocurrency to any of your choices.

• Great for instant conversion. |

8.7/10 | 747 |

| Bitfinex | • High trading volume and liquidity | 111 | |

| Coinbase | • A U.S.A. regulated exchange based out of California. | 9.1/10 | 211 |

| Kraken | • Based out of the USA, and secure crypto exchange, existing for the last half a decade. | 346 | |

| KuCoin | • Simple and easy to use

• Many low-cap gems available |

325 | |

| 1inchexchange | • Best decentralized exchange aggregators of the market

• Custody of funds remains with the user |

474 | |

| CEX | • Simple and easy to use | 202 | |

| Bybit | • Very popular with high volume.

• Ideal for margin trading. • Read Bybit review |

– |

Slowly and steadily, Bitcoin and altcoins are getting attention from more investors all around the world.

And why not? These cryptocurrencies are time and again proving themselves to be a safe haven against the government’s inflationary policies.

Not only this, but now people have a variety of products to earn substantial passive income on their crypto assets. Moreover, some people make good money by pure speculation with short-term trading (i.e., buy low, sell high).

And for those who are just starting and need answers to some basic questions like:

- Where do I buy such cryptocurrencies?

- What are the best cryptocurrency exchanges?

- Which crypto exchange is secure and user-friendly?

But before we talk about the best exchanges out there, I need to tell you that it’s not too late to get invested in cryptocurrencies. At the time of this writing, the Bitcoin and altcoin market is at a market cap of $1.18 Trillion. I believe we will cross the $3 Trillion mark in the next year.

So now that you know that you should invest, here’s where you need to go to do that.

Note: This list starts from easy-to-use exchanges and moves towards some of the advanced exchanges.

11 Best Cryptocurrency Exchanges for Trading Cryptocurrency

1. Binance

Binance is the world’s leading cryptocurrency exchange that concluded its ICO on 21st July 2017 and raised $ 15 Million. In addition to being a blazing fast exchange, The platform is designed for traders of all levels, i.e., from a beginner trader to an advanced trader.

The platform offers an inbuilt wallet which is ideal for storing Bitcoin for a short time. In addition, Binance has an Earn feature to deposit your crypto assets such as Bitcoin or USDT, and earn interest on your holdings.

Since its ICO to date, it has grown tremendously. It has become the leading cryptocurrency exchange globally in trading volume and availability of pairs of a token. It now has over 370+ altcoins listed on it, which are further provided in over 1300 pairs. Additionally, coin listing is increasing with every passing month.

Binance being a centralized exchange has taken a unique take to expand its business and provides a decent discount for day traders if they use BNB coins. BNB is the native currency of this platform, saving money on buying/selling any coin.

Binance is a global exchange that is ideal for everyone and has the highest liquidity. Users from the USA can signup for Binance.us. Use the table below to pick the ideal Binance exchange for your jurisdiction:

| Binance Global | Sign up here (10% trading fees off) |

For everyone (Users from all countries) except the USA |

| Binance USA | Sign up here (Get $15) |

For the USA users |

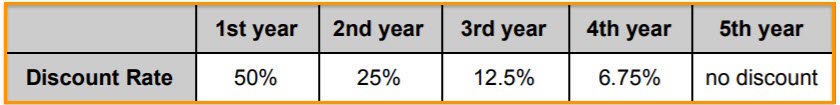

Binance’s fee structure is also unique.

It has a 0.1% standard trading fee that is already relatively less than its peers. You can even reduce your fee further if you pay your trading fee in BNB according to the below-shown structure.

To get started with Binance, you need to register using your email ID and the process is simple & fast. Binance is one of the few exchanges that offer mobile apps for iOS and Android.

Read: Binance Review: Features, Fees in 2022 (Beginner’s Guide)

Being using it for a while, I find it too easy to trade cryptocurrency while on the move. However, you can watch this video to learn how to use its mobile app.

They also have aggressive plans like multi-lingual support, mobile apps for both iOS and Android users, the Binance lending program, and the Community Coin Per Month, etc for more adoption of their platform.

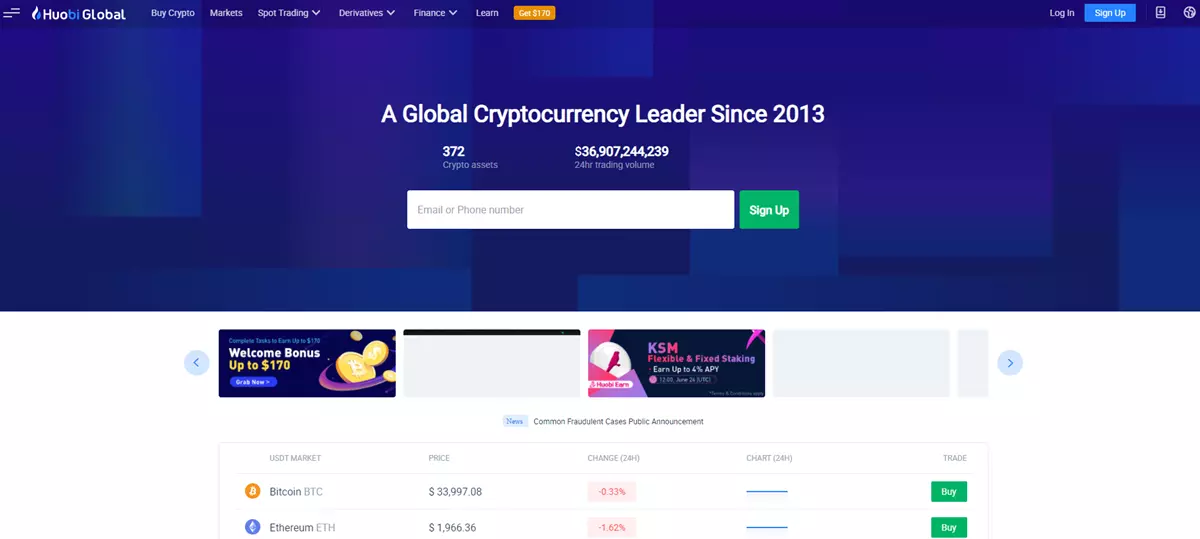

2. Huobi Global

Huobi is an international cryptocurrency exchange that originated in China but now has moved across the world to serve a maximum number of investors. It is based out of Singapore and has been operating in this space successfully for the last five years.

As we speak, it occupies the #2 spot on CoinMarketCap’s list of exchanges by volume and has 973 cryptocurrency pairs. Hence, you will never face liquidity problems on this exchange.

They also have a mobile app for Android and iOS for users who want to trade cryptos on the go.

Their registration process is also pretty simple, so go ahead and do the needful. Oh, and just so you know, the exchange fee is also pretty low. Have fun.

Do read Huobi Exchange Review: Pros and cons

3. Changelly

Changelly is one of the easiest ways to get ahold of various cryptocurrencies.

Changelly has a proven track record of consistently good products being put out into the crypto space.

One of the best things about Changelly is that you don’t need to go through any lengthy verification or registration process. It is a non-custodial exchange.

Currently, Changelly supports around 199 cryptocurrencies along with fiat pairs such as USD/EUR. It is one of the best and easiest to use crypto exchanges out there.

When you use Changelly to exchange cryptocurrency, the matching engine connects in real time to some of the best and busiest cryptocurrency exchanges in the market to get you the best price.

Usually, when using Changelly, a crypto-to-crypto exchange takes 2 to 20 minutes.

The amount you see is the amount you get, so you don’t have to worry about any hidden fees or charges.

All you need to buy from Changelly is a VISA/MasterCard (credit/debit card) and a wallet where you want to receive your new coins.

The procedure is very simple.

Head toward Changelly, and follow the on-screen instruction to exchange your coins.

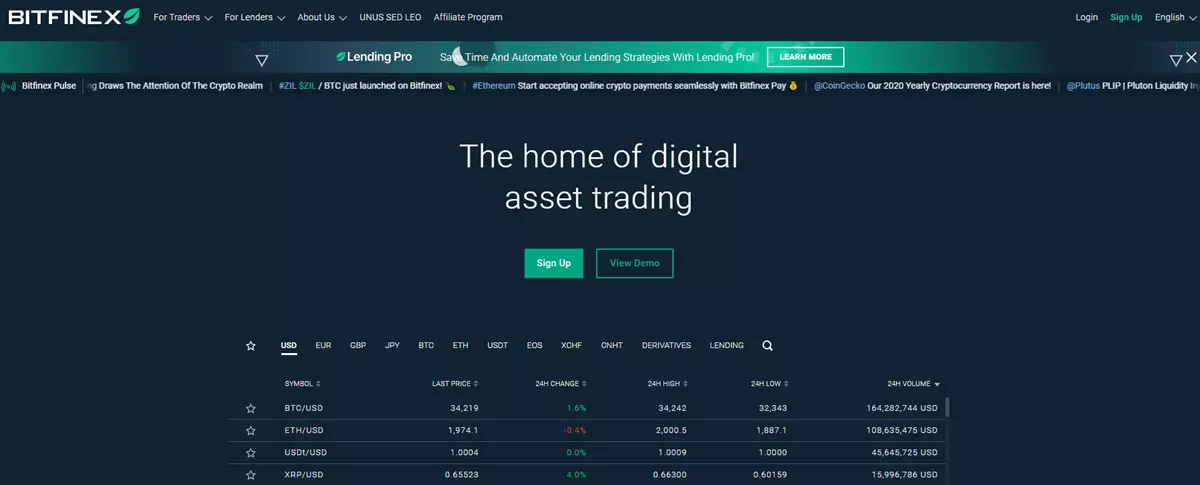

4. Bitfinex

Bitfinex is another one of the largest and most popular cryptocurrency exchanges out there.

Based out of Hong Kong and operational since 2014, it gives its users the option to trade in 139 cryptocurrencies offered in 320 different trading pairs.

You can trade using USD (with a wire fee of at least $60). Also, users will need to pay a trade fee which varies from 0.1% to 0.2% (details here).

Also, whenever you withdraw or deposit anything, you are charged a certain fee:

On Bitfinex, if you are a pro-trader, you will find advanced trading tools such as limit orders, stop orders, trailing stop, fill or kill, TWAP, and others, along with different market charts.

And whenever you get bored with the web version or want to trade on the go, you can use Bitfinex’s Android and iOS mobile apps.

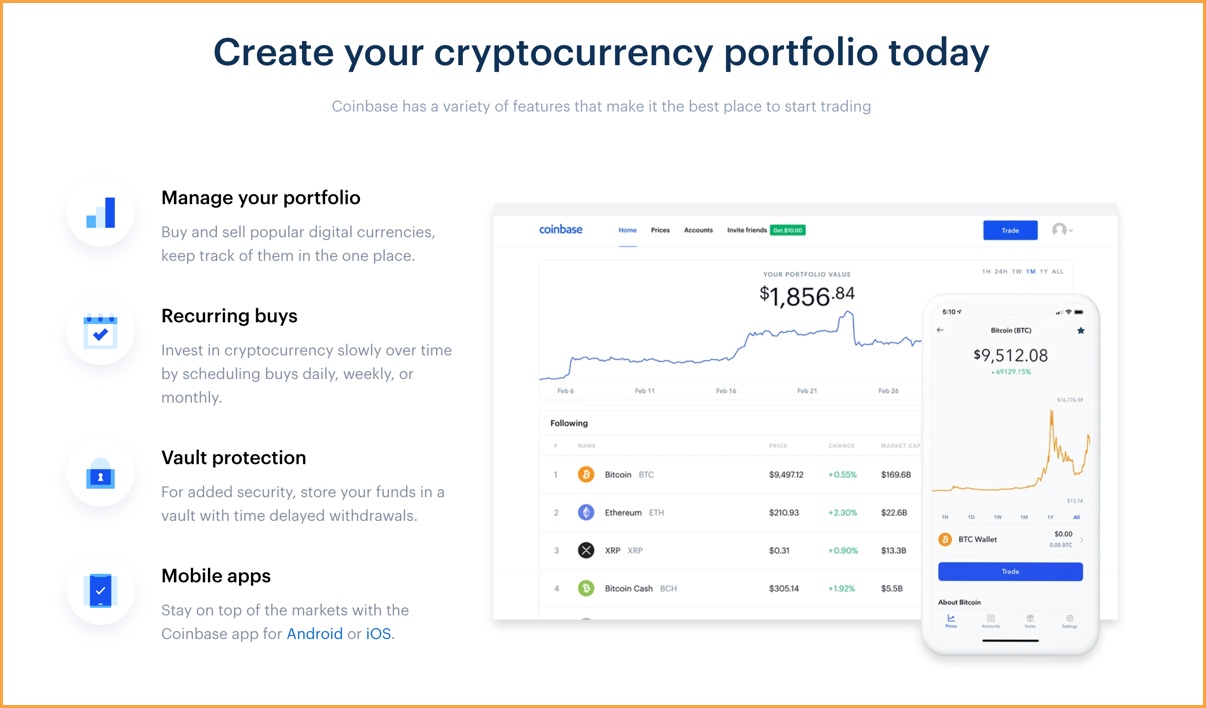

5. Coinbase

Coinbase is a U.S.-based crypto exchange that serves a global audience. The exchange offers excellent speed and reliability and is beginner-friendly.

Using Coinbase, you can quickly buy cryptocurrencies and trade at the same time. They have an app for iOS and Android, which gives you the comfort of exchanging cryptocurrencies from anywhere. The wire transfer feature is also available on Coinbase.

The security standard of Coinbase is enterprise-grade, and they have been around for many years. Coinbase is supported in almost all continents (Africa, Asia, Australia, Europe, North America, and South America)

The exchange has listed 72 cryptocurrencies which are offered in 232 different trading pairs. Coinbase also supports popular stablecoins such as DAI and USDC which is an important aspect of any popular cryptocurrency exchange.

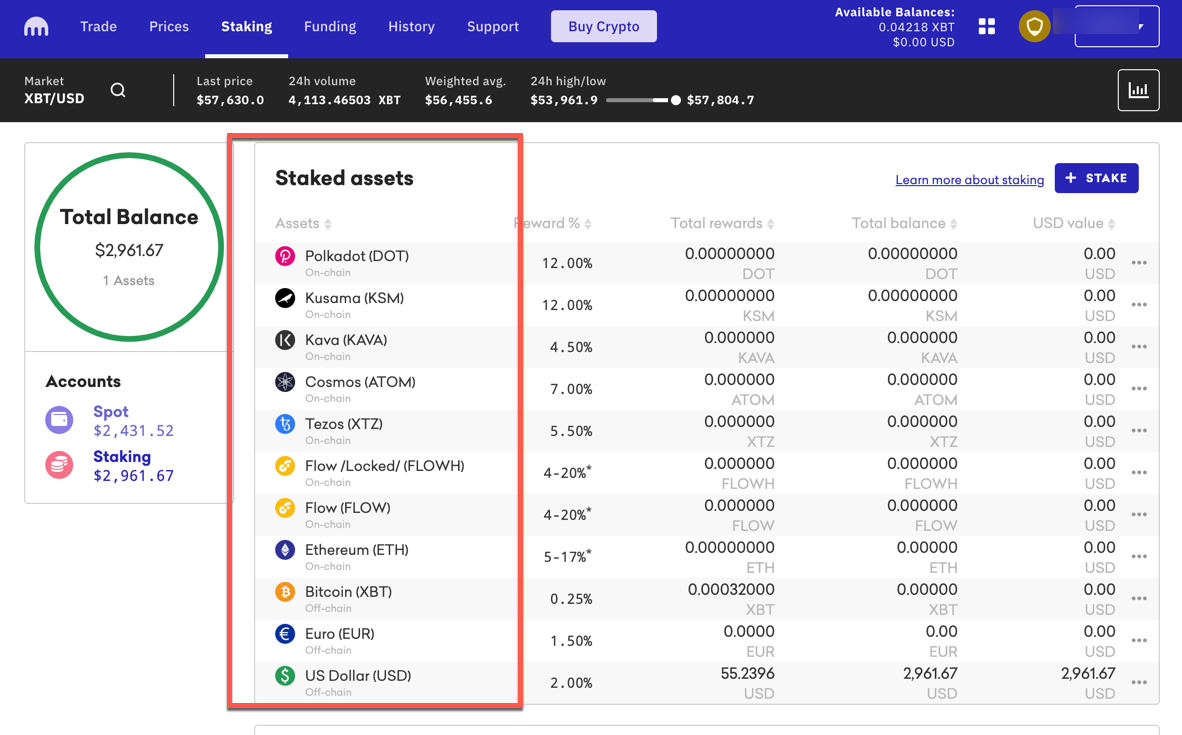

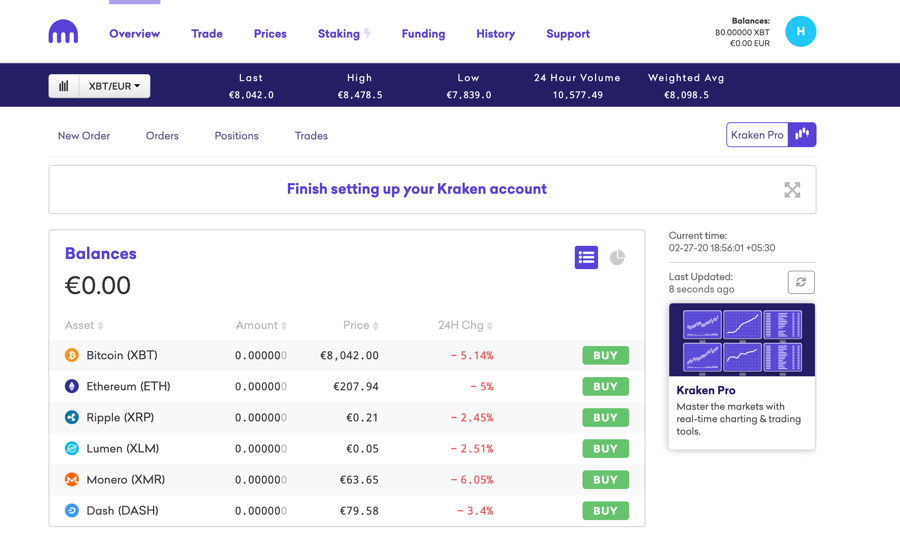

6. Kraken

Kraken is one of the oldest crypto exchanges that has existed for over a decade now. Established in 2011, the exchange offers Bitcoin as well as a number of known altcoins. In total it offers 346 pairs of crypto tokens. Read more detailed review of Kraken.

The exchange has an interactive web version as well as mobile applications for Android and iOS users. The features of the platform can be fully explored by an advanced crypto user.

Features such as take profit orders, take profit limit orders, etc. are some of the unique features of the platform.

Kraken also offers derivatives products on which margin is available up to 50x. Further, it has options to earn passive income such as staking.

You can use Kraken to deposit and withdraw funds to any bank account globally. In my experience of using Kraken, bank transfers is quick, and support is excellent.

7. KuCoin

KuCoin is another easy and hassle-free cryptocurrency exchange. KuCoin offers many popular and unique coins such as CHR, $KCS, and many others. Just like Binance, they offer a fully functional mobile app for Android and iOS.

To get started with KuCoin, you can deposit any crypto of your choice, ex: BTC, and start trading. I have been using KuCoin for the past two years, and they have constantly been adding extra features.

You can use Kraken to deposit and withdraw funds to any bank account globally. In my experience of using Kraken, bank transfers are quick, and support is excellent.

Overall, Kraken is one secure and trustable exchange that you should check out.

8. 1inchexchange

All the exchanges in my list are centralized exchanges. This means an exchange that has a record of your identity and holds your private keys for you.

People who specifically want to trade anonymously and to keep custody of their funds should choose a decentralized exchange.

1inchexchange is the best DEX (Decentralized Exchange) aggregator which consolidates prices from various other DEXs and brings the best price for you.

The platform is very secure and provides better liquidity than any other Decentralized Exchange. I would suggest you much try this platform once to have a touch base of the Decentralized Financial eco-system.

9. CEX

CEX.io was established in London, United Kingdom in 2013. Originally the organization was a cloud mining service provider which handled a number of cloud mining pools. In 2015, the organization dropped the mining service business and focussed completely on the exchange services.

In 2017, the exchange was audited by a third-party audit firm which confirms its compliance company’s diligent approach towards crime prevention. In 2019, the company set up its offices in nine US states and has been expanding since then.

The exchange has 80 different crypto tokens which are offered as 201 different trading pairs.

Features of CEX.io are as follows:

- Spot Trading and Margin Trading

- Derivatives Trading (in form of Contracts for Difference (CFD))

- Fiat to crypto transaction for 4 cryptocurrencies (USD, EUR, GBP, RUB)

- Options to earn passive income through staking and savings

- Crypto backed loans

In addition to this The exchange also offers a Demo Account for paper trading. The basic trading fee is 0.25% for a taker and 0.16% for a maker.

The platform is secure and easy to use. Along with an interactive web application, it offers a mobile application for Android and iOS users.

Read a review of CEX.io exchange

10. Bybit

Bybit is a specialized spot and crypto derivatives market exchange. Established in March 2018, Bybit is one of the fastest growing cryptocurrency exchanges, with more than 3 million registered users.

Further, the exchange offers a margin on the above derivatives upto 100x. In case you are looking for an exchange for spot and derivatives trading, then Bybit is the best bet.

The platform is adding quality and trending coins every other day, and it might become the fastest growing crypto exchange of 2022. It is one of the best crypto exchanges which is secure and easy to use. It has an interactive web application and a mobile application for Android and iOS users.

For beginners, Bybit also has a feature of paper trading.

Read our full review on Bybit here.

What if a user needs some low market cap gems?

Using the above cryptocurrency exchanges will allow you to buy almost all of the cryptos you could ever want to buy.

However, there are a few more cryptocurrency exchanges that you should have an account with, as there are a few coins that are only available there. It’s a good idea to have an account on most of these, which will save time when you discover a winning coin.

So, here are some bonus exchanges which I am sure you would love.

11. MEXC Global

MEXC Global (formerly known as MXC) was established in 2018 in Seychelles, East Africa. The exchange has listed 518 coins which are offered as 887 different pairs.

You can use MEXC Global for spot, margin, and derivatives trading. In addition to this MEXC Global provides several features such as ETF (Exchange Traded Funds) Trading, staking, DeFi Farming, etc.

The trading fee on MEXC Global is 0.2% of the transaction value. This fee can be discounted by holding the in-house token of MEXC Exchange i.e. MX Token.

The benefits of using MEXC Global Exchange are as follows:

- The platform has a very user-friendly interface

- The platform has an interactive mobile app that allows you to trade on the go

- You can earn passive income through staking and depositing assets in DeFi products

Please read our full review on MEXC Global Exchange here.

12. AscendEX (BitMax)

AscendEX (formerly known as BitMax) was established in 2018 in Singapore. Founders George Cao and Ariel Ling have substantial experience in investment banking and traditional stock markets.

The exchange provides the following services:

- Spot, Margin, and Futures Trading

- OTC (over-the-counter) Trading (for bulk purchases)

- Fiat to crypto purchase

- Staking (to earn passive income on your crypto assets)

- DeFi Yield Farming (to earn passive income on your crypto assets)

AscendEX has listed 186 tokens on the platform, which are offered as 299 pairs of tokens. The trading fee of the platform is 0.1% for large-cap tokens and 0.2 for altcoins.

The benefits of using AscendEX are as follows:

- Copy-trading feature for futures trading(you can copy trade settings of professional traders)

- Passive income earning options available (staking and DeFi Yield Farming)

- The exchange has a user-friendly interface

So that is it for my list of most reliable cryptocurrency exchanges. Now, with such an information overload there is a need to summarise this information. Let us understand how to choose the best crypto exchange for ourselves.

How to select the best cryptocurrency exchange for you?

Following are the crucial factors you should consider while choosing the best crypto exchange for yourself:

Almost all exchanges have a list of supported countries. Residents outside these jurisdictions should not use these exchanges.

Further, you should also check whether your native fiat currency is supported by that exchange or not. If not, then you need to figure out a way to transfer your funds to this exchange.

Security is the key factor for the sustenance of the whole crypto market. Before choosing an exchange for yourself, you should have an answer to these questions:

- Who keeps custody of my funds?

- Is there any security audit done on the exchange? What was the conclusion?

- Where are the funds of the exchange kept? Is the place secure enough?

- Does the exchange has any insurance in case of loss of funds due to a security breach?

Once you have answered the above questions, you will be able to judge the security of the said platform.

- Whether it is centralized or decentralized

Centralized exchanges need your personal details before they allow you to trade on their platform. Further, most of these exchanges keep custody of your funds.

This is not the case with a decentralized exchange.

Some exchanges although very good in product offerings have a very complicated user interface. This leads to confusion in understanding the product or method of transactions.

Thus, you should choose an exchange that has an interactive web application and a compatible mobile application.

- Liquidity and Trading Volume

If you want to purchase a token, you need to ensure whether people are interested in selling that token on the exchange. Thus, liquidity means the availability and scale of crypto funds on a particular exchange.

For this, you should check the number of trading pairs supported by the platforms and the 24-hour trading volume of the platform.

KYC stands for Know Your Customer. Almost all the centralized exchanges have a KYC Policy basis that collects information of user and enable them to use the platform.

What you need to check is the type of information collected as well as the time in which verification is done by the exchange.

On every transaction, a trading fee would be charged by the exchange. This trading fee is a cost to you and thus you should try and choose an exchange with the lowest trading fee.

- The reputation of exchange in the market

A crypto exchange is an intermediary between a buyer and a seller. Therefore, you need to ensure that an exchange is legit and does not have a bad reputation in the market.

For this, you should search for any possible scams that an exchange could have been a part of.

- Relationship of the exchange with the country’s authorities

Lastly, you should check whether a crypto exchange is in line with the regulations of your country. In case an exchange is banned by the authorities, you should not use that exchange in any case.

Conclusion – Best Crypto Exchanges 2022

Trust me, I have squeezed my 5 years of experience in the crypto markets in this single post. My objective is to bring you the most feasible products of the crypto markets and help you in earning life-changing money.

I will update this post as I find other trustable and feature-rich cryptocurrency exchanges. For now, you can consider joining our Telegram channel to stay updated with all the latest info.

I hope these insights help you in choosing the best cryptocurrency exchange for you to use.

But one word of caution:

Don’t use these exchanges as a wallet to HODL your cryptos. If you are storing cryptocurrencies on these exchanges for a few hours or even a few days for the sake of trading, then it’s probably OK. Otherwise, this is a bad practice.

Large-scale hacks like Mt. Gox can happen at any time. I would strongly recommend you to use the Ledger Nano S or a wallet like Atomic, where you can store a lot of different cryptos and control your private keys.

So now it’s your turn to tell me: Which one of these exchanges do you like the best? Also, what’s another great exchange that I haven’t listed here? Let me hear your thoughts in the comments below!

Here are a few hand-picked articles you should read next:

Are any cryptocurrency exchanges regulated

Which are the best cryptocurrency exchanges?

As mentioned above, the following are the top cryptocurrency exchanges:

1. Binance

2. Huobi Global

3. Changelly

4. Bitfinex

5. Coinbase

6. Kraken

7. KuCoin

8. 1inchexchange

9. CEX

10. Bybit

Which cryptocurrency exchange has the lowest fees

What is the best Cryptocurrency exchange for beginners?

Changelly or Changenow is the best for those looking for an instant exchange of coins. On the other hand, Binance offers the biggest ecosystem, and the platform is also beginner-friendly.

Which Cryptocurrency exchange has the most coins?

Binance has the maximum number of coins that are of high quality.

Like this post? Don’t forget to share it with the world!