The stock market, as measured by the S&P 500 Index

SPX,

), has been moving upward. The U.S. benchmark index is essentially crawling up the higher “modified Bollinger Bands” (mBB), which is a bit of an overbought condition, but not a sell signal.

The next major resistance appears to be in the 4650 area, which at one time seemed far away but is now within range. There is minor support at 4527 (last week’s lows), with stronger support below that, at 4440, 4385, 4330 and 4200. Given the strong upward momentum of the market, a couple of those could be violated without giving the bull market any problem, but a fall below 4330 would be a game changer.

The S&P 500 has recently closed above the +4σ mBB, which sets up a “classic” sell signal. That “classic” signal was generated on Thursday when SPX closed below the +3σ Band — 4560. But we do not trade the “classic” signals, preferring to wait for the further confirmation of a McMillan Volatility Band (MVB) signal. Just because a “classic” sell signal has occurred does not mean that a MVB sell signal will automatically follow. We will keep you up to date on these developments weekly.

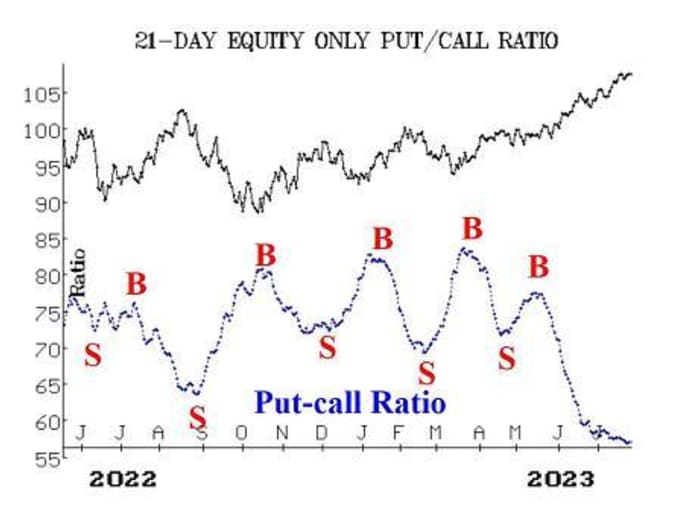

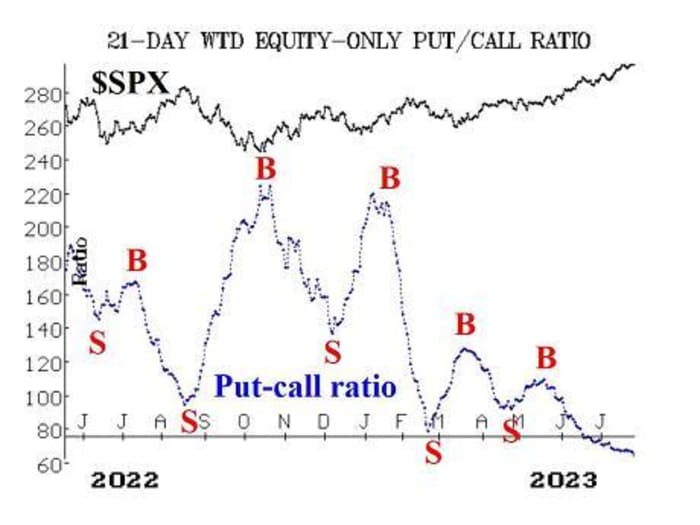

Equity-only put-call ratios have continued to edge lower as stocks have risen. This means that the put-call ratios are still on buy signals, but they are in deeply overbought territory because they are so low on their charts. The computer programs that we use to analyze these charts are once again warning of a sell signal, but we prefer to wait until we can visibly see the ratios begin to rise before taking on any negative position based on these ratios. Despite the fact that these ratios are at lows for the last year or so, it should be noted that they were much lower all during the 2021, as that bull market was pressing forward, and eventually gave way to a bear market.

Market breadth has been generally positive. Both breadth oscillators are on buy signals and are in overbought territory. They could withstand a day or two of negative breadth and still remain on those buy signals. Perhaps more importantly, cumulative volume breadth (CVB) is approaching what could be a major buy signal. If CVB makes a new all-time high, then SPX will follow. CVB is within just a small distance of its all-time high and could attain that today. Doing so would mean that an upside target of 4800+ would be in force for SPX.

New Highs on the NYSE continue to dominate New Lows, so this indicator remains strongly positive for stocks.

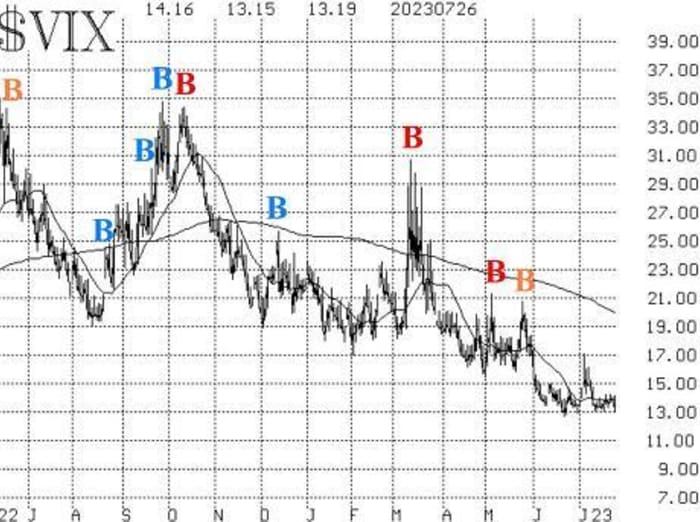

VIX

VIX,

is languishing between 13 and 14. As long as this continues, stocks can rise. The only time problems would surface would be if VIX spurted higher. So far, that hasn’t happened. It appears that “big money” still has some fear of this market, so they are buying SPX puts, keeping VIX a bit elevated. It should also be noted that VIX normally makes its annual low in July and begins to rise in August. So that is a potentially negative seasonal factor on the horizon.

The construct of volatility derivatives remains bullish for stocks, since the term structures of both the VIX futures and of the CBOE Volatility Indices continue to slope upwards.

Overall, we are maintaining our “core” bullish position because of the bullish SPX chart. We are raising trailing stops and rolling deeply in-the-money calls upward as we go along. Eventually, we will trade other confirmed signals around that “core” position.

New recommendation: Potential CVB buy signal

We made this recommendation last week and recommended using the cumulative total of daily NYSE advancing volume minus declining volume as a guide. That cumulative total did reach our projected value as of July 26. In reality, the “stocks only” CVB ended just shy of a new all-time high. We are going ahead with the recommendation, since the way that we stated it last week did generate the buy signal.

Buy 4 SPY Sept (29th) 480 calls: Since CVB reached a new all-time high, we are going to buy SPY

SPY,

calls with a striking price equal to SPY’s all-time high. We will hold without a stop initially.

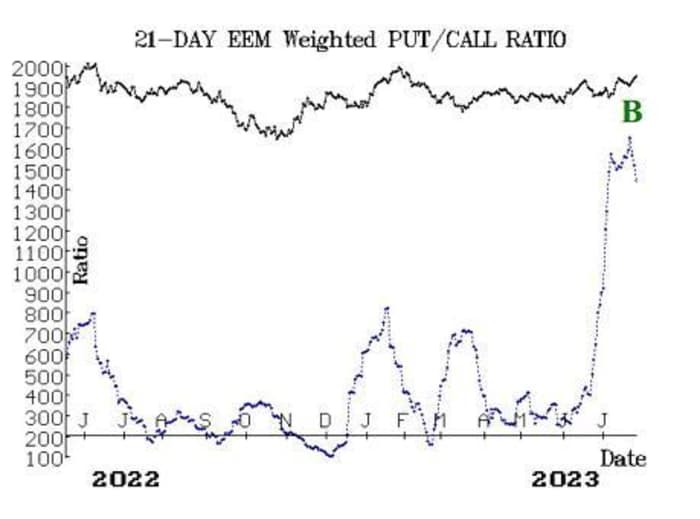

New Recommendation: Emerging markets ETF (EEM)

There has been a high-level buy signal generated from the weighted put-call ratio for the Emerging Markets ETF

EEM,

Put buying has been extremely strong for more than a month and is now is abating. This has generated the buy signal.

Buy 5 EEM Oct (20th) 41 calls in line with the market

We will hold these calls as long as the EEM weighted put-call ratio remains on a buy signal.

Follow-up action:

We are using a “standard” rolling procedure for our SPY spreads: in any vertical bull or bear spread, if the underlying hits the short strike, then roll the entire spread. That would be roll up in the case of a call bull spread, or roll down in the case of a bear put spread. Stay in the same expiration and keep the distance between the strikes the same unless otherwise instructed.

Long 800 KOPN:

KOPN,

The stop remains at 1.70.

Long 2 SPY Aug (4th) 453 calls: This is our “core” bullish position. The calls have been rolled up three times. Stop out of this trade if SPX closes below 4330. Roll up every time your long SPY option is at least 6 points in-the-money.

Long 1 SPY Aug (4th) 453 call: Bought in line with the “New Highs vs. New Lows” buy signal. The calls have been rolled up three times. Stop out of this trade if, on the NYSE, New Lows outnumber New Highs for two consecutive days. Roll up every time your long SPY option is at least 6 points in-the-money.

Long 2 PFG Aug (18th) 80 calls: This position has been was rolled up twice. We will hold this PFG

PFG,

position as long as the weighted put-call ratio remains on a buy signal.

Long 10 VTRS

VTRS,

August (18th) 10 calls: The stop remains at 10.15.

Long 5 CCL

CCL,

Aug (18th) 17 calls: Raise the stop to 17.10.

Long 2 PRU

PRU,

Aug (18th) 87.5 calls: We will continue to hold these calls as long as the weighted put-call ratio remains on a buy signal.

Long 8 CRON

CRON,

Aug (18th) 2 calls: Hold these calls without a stop while takeover rumors play out.

Long 6 ORIC

ORIC,

Aug (18th) 7.5 calls: The stop remains at 7.40.

Long 2 EW

EW,

Aug (18th) 95 puts: Continue to hold these puts as long as the weighted put-call ratio remains on a sell signal.

All stops are mental closing stops unless otherwise noted.

Lawrence G. McMillan is president of McMillan Analysis, a registered investment and commodity trading advisor. McMillan may hold positions in securities recommended in this report, both personally and in client accounts. He is an experienced trader and money manager and is the author of the best-selling book, Options as a Strategic Investment. www.optionstrategist.com

©McMillan Analysis Corporation is registered with the SEC as an investment advisor and with the CFTC as a commodity trading advisor. The information in this newsletter has been carefully compiled from sources believed to be reliable, but accuracy and completeness are not guaranteed. The officers or directors of McMillan Analysis Corporation, or accounts managed by such persons may have positions in the securities recommended in the advisory.

Source link

#run #stock #markets #bulls #watch #exits