February was a strong month for stocks and the Club’s portfolio. The advance came as investors parsed through fourth-quarter earnings results and fresh economic data, searching for clues about when the Federal Reserve will finally cut interest rates. The Nasdaq Composite led the march higher in February, gaining 6.1% and finishing the month at its first record close since November 2021. Meanwhile, the Dow Jones Industrial Average and S & P 500 both hit a series of all-time highs throughout the month, climbing 2.2% and 5.2%, respectively. The Club held its conviction on stocks with positive long-term fundamentals, buying Palo Alto Networks shares during the cybersecurity company’s overblown post-earnings selloff. We made a handful of other trades, too, such as adding to our Wynn Resorts position and booking profits in Wells Fargo. Although the majority of our 32-stock portfolio ended February in the green, five holdings separated from the pack. NVDA YTD mountain Nvidia (NVDA) year-to-date performance Nvidia was our top-performing stock for February. Shares surged 28.6% in the month on the back of stellar quarterly results and continued investor optimism in generative artificial intelligence. Despite briefly losing some steam ahead of its Feb. 21 earnings release, the stock resumed its winning ways once investors saw the actual numbers. It closed Thursday at a record high of $791.12 per share. After earnings, the Club lifted its Nvidia price target to $850 per share, from $750, because we see little reason for the chipmaker’s run to end as AI investments continue apace. Following a monstrous gain in 2023, Nvidia is up another 59.75% so far in 2024. META YTD mountain Meta Platforms (META) year-to-date performance Coming in at No. 2 is Meta Platforms , which advanced 25.6% over the period. Shares of the Facebook parent received a boost from its Feb. 1 earnings release , rocketing higher by 20.3% in the following session. Investors celebrated Meta’s robust first-quarter guidance and decision to institute a quarterly dividend – a positive sign for the company’s long-term health. During the Investing Club’s Annual Meeting on Saturday, Jim Cramer described Meta CEO Mark Zuckerberg as “a very competitive guy,” saying “he heard people wanted a dividend, so he gave them a dividend.” The Club also elevated Meta into our 12-stock group of core holdings . GEHC YTD mountain GE Healthcare (GEHC) year-to-date performance GE Healthcare shares jumped 24.4% during February, occupying the No. 3 spot. Like Nvidia and Meta, the company saw more upside after its quarterly results on Feb. 6. Expectations were low on concerns around China’s health-care industry crackdown, but management delivered with better-than-anticipated results and upbeat guidance. We nudged up our price target on the medical equipment maker’s stock to $92 per share from $91. Once a battleground stock, GE Healthcare generated praise from Wall Street analysts after the quarter, as well. Its former parent company, General Electric, also sold some of its remaining GEHC shares later in the month, helping chip away at a long-standing overhang for the Club stock. GE Healthcare also is a core holding. FL YTD mountain Foot Locker (FL) year-to-date performance Foot Locker was the portfolio’s fourth-best stock in the month. Shares rose 22.3% during February, though they are still firmly below their year-ago levels. It’s hard to pinpoint a singular factor driving Foot Locker’s stellar performance in February, but a positive update surrounding the retailer’s partnership with Nike was likely welcome news for investors. That’s because in recent years Nike has tried to build out its direct-to-consumer business, weighing on wholesale partners like Foot Locker. More signs of cross-collaboration is good news for the Club holding. Still, its earnings next week will be a test to see if the rally was justified, or if there was a setback in CEO Mary Dillon’s turnaround strategy. BHC YTD mountain Bausch Health (BHC) year-to-date performance Bausch Health stock jumped 19.6% in February, grabbing the final sport in the top five. Its best session of the month came on Feb. 22, when shares jumped 7.3% after the troubled Canadian pharmaceutical firm delivered a quarterly earnings beat . Nevertheless, the company’s ongoing legal battles remain a crucial overhang for the stock. Bausch’s most important drug, Xifaxan, which accounts for roughly 40% of its revenue, is ensnared in a patent fight that could dampen its commercial future. On Thursday, we decided to sell roughly one-fourth of our Bausch Health stake to hedge against potential downside from future court rulings. (Jim Cramer’s Charitable Trust is long PANW, WYNN, FL, BHC, GEHC, META, NVDA . See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Traders work on the floor at the New York Stock Exchange (NYSE) in New York City, U.S., February 23, 2024.

Brendan McDermid | Reuters

February was a strong month for stocks and the Club’s portfolio.

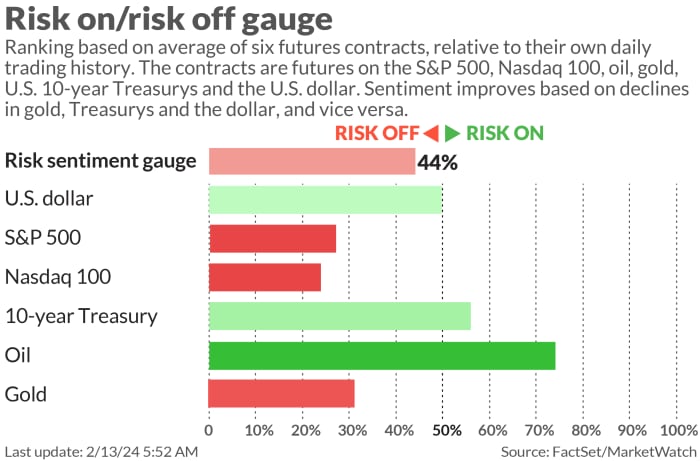

The advance came as investors parsed through fourth-quarter earnings results and fresh economic data, searching for clues about when the Federal Reserve will finally cut interest rates. The Nasdaq Composite led the march higher in February, gaining 6.1% and finishing the month at its first record close since November 2021. Meanwhile, the Dow Jones Industrial Average and S&P 500 both hit a series of all-time highs throughout the month, climbing 2.2% and 5.2%, respectively.

Source link

#February #great #month #Wall #Street #bestperforming #stocks