Rigorous testing reveals Trade Ideas is the best AI stock backtesting and integrated auto-trading software. TradingView offers great free backtesting software for stocks and auto trading. TrendSpider has powerful pattern recognition, backtesting, and auto-trading.

With over two decades of investing and trading experience, I have personally developed many backtested systems and strategies, two of which beat the market and are profitable, the Beat the Market strategy I developed on Stock Rover and the MOSES system I developed on Tradingview.

Review & Test Methodology

I have personally installed, tested, and used all of the backtesting and auto-trading software in this review. Rating points were awarded for features, benefits, ease of use, backtest reporting, and the ability to execute trades. The use of AI to support the trader has also been awarded extra points.

Stock Backtesting & Auto Trade Software Summary

Our research shows the best stock backtesting and auto-trade software are Trade Ideas, Tradingview, and TrendSpider. Our testing process selected Trade Ideas as the best because its fully automated AI system performs the backtesting for you and has fully integrated auto-trading.

Tradingview offers an intelligent, robust stock backtesting solution for free, including auto trading using webhooks. TrendSpider also provides innovative AI-driven automated backtesting and auto-trading using webhooks. MetaStock is the most powerful stock backtesting & forecasting platform for broker-agnostic traders but has no automated trading.

Stock Rover and Portfolio123 enable ten years of fundamental financial backtesting for investors but do not have auto-trade functionality.

Backtesting & Auto Trade Software Comparison Table

Best Backtesting Software for Traders

- Trade Ideas: Best AI Backtesting & Auto Trade Software

- Tradingview: Best Backtesting & Auto-trading Globally

- TrendSpider: Best Backtesting, Pattern Recognition & Auto-trading

- MetaStock: Best Chart Backtesting & Forecasting

- Tradestation: Great Backtesting For Tradestation Clients

Best Backtesting Software for Investors

- Stock Rover: Best Backtesting Software for USA Investors

- Tickeron: Backtesting Software, AI Signals & Pattern Recognition

- Portfolio123: Stock Backtesting & Research for Investors

- Interactive Brokers: Good Fundamental Backtesting

Top 10 Best Stock Backtesting Software

1. Trade Ideas: Best AI Backtesting & Auto Trade Software

Trade Ideas wins our review by providing the best AI-driven automated backtesting and auto-trade software, offering day traders specific audited trading signals for high-probability trades.

I recommend Trade Ideas for day traders wanting specific artificial intelligence-driven backtested trading signals and the option to auto-trade commission-free with eTrade.

Trade Ideas introduces us to a world where you do not need to manually backtest your stock trading theories for hundreds of hours, to get an edge in the market. With Holly AI, the work is done for you.

Trade Ideas Key Features

We independently research and recommend the best products. We also work with partners to negotiate discounts for you and may earn a small fee through our links.

Pros

- 3 AI Trading Algorithms That Beat the Market

- Fully Automated Backtesting

- Exceptional Stock Scanning

- Specific Audited Trade Signals

- Auto-trading With AI Signals

- Live Daily Trading Room

Cons

Trade Ideas Backtesting Software Discounts

At first, access to the Holly AI system might seem a little pricey. You will need to go for Trade Ideas Premium, which costs $228 per month, or you can save $468 by going for an annual subscription costing $2268. You get access to robust backtesting and the Holly Artificial Intelligence System for this investment.

Trade Ideas Backtesting

Trade Ideas has three AI algorithms that automatically backtest stock chart patterns and volume conditions to find high-probability trades for day traders. Holly, Holly 2.0, and Holly Neo are trading algorithms that constantly backtest millions of real-time conditions to find trading opportunities. Each recommended trade has a win probability and a full set of backtested data for you to review.

You can also build your backtesting strategies using Trade Ideas and set the system to auto-trade for you.

- AI Virtual Trading Analyst Holly: 3 different constantly evolving AI algorithms

- Chart-Based AI Trade Assistance & Entry and Exit Signals

- Risk Assessment: Detailed information on the backtested performance of the recommended trade.

- Build and Backtest any Trade Idea: Compelling point & click backtesting system.

- Autotrade w/ Brokerage Plus and AI – Advanced auto trading commission-free with Etrade.

Trade Ideas Backtesting

Trade Ideas is powerful backtesting software, which is easy to use, and you do not need to have any programming knowledge. A point-and-click backtesting system is rare in this industry; the only good software with this capability is TrendSpider.

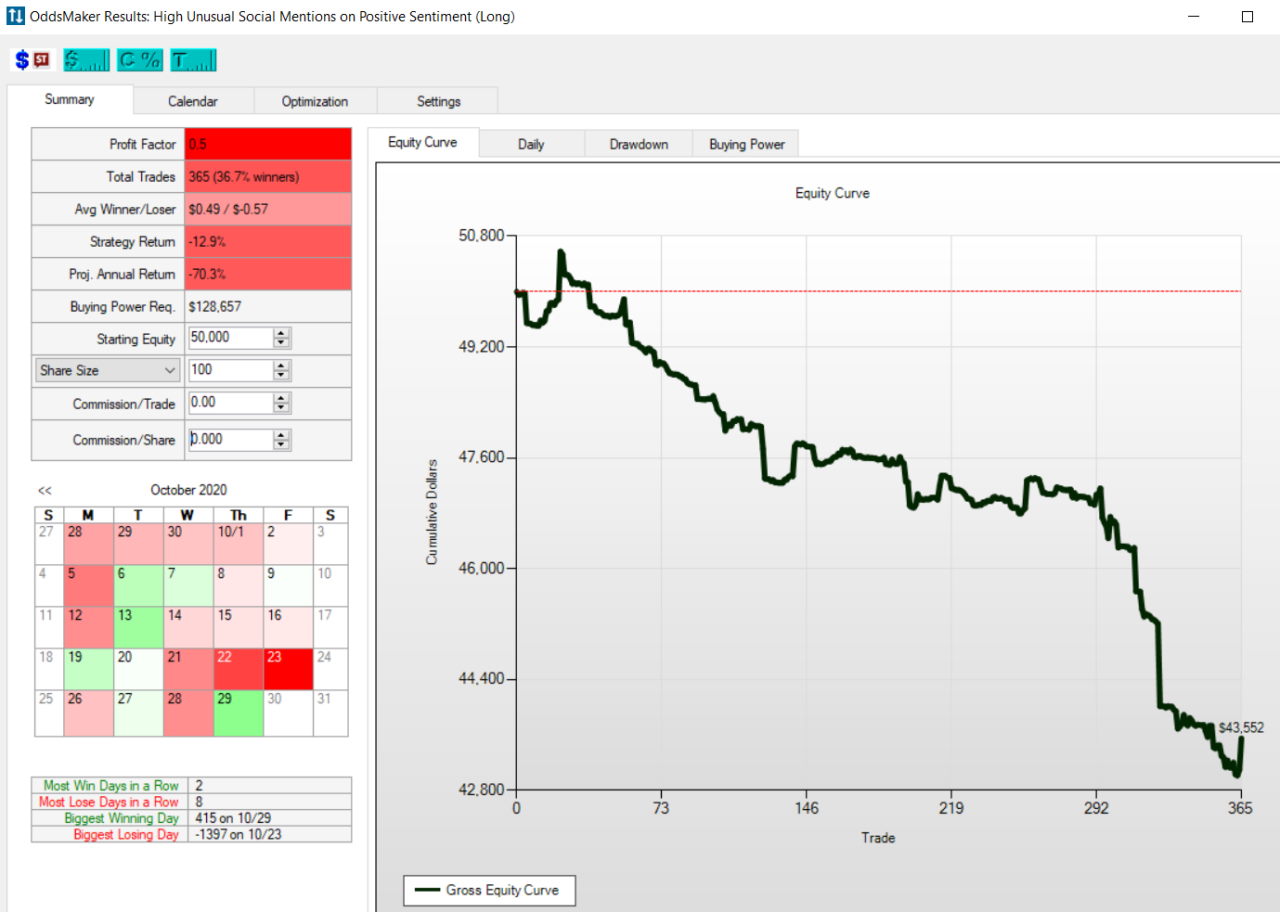

I have run many backtests with Trade Ideas, but the one I wanted to focus on was a backtest of the “Unusual Social Mentions Scan.” This is a good test of the wisdom of crowds.

I wanted to focus on was a backtest of the “Unusual Social Mentions Scan”. This is a good test of the wisdom of crowds.

As you can see in the backtest result above, the crowds are not very wise, as the backtest shows that the system loses 70% per year. This helps me draw three conclusions.

- Do not listen to people on social media.

- Trade Ideas provides an excellent and unique insight into stock market crowd sentiment.

- You may have a winning system if you do the opposite of what people suggest on StockTwits.

Trade Ideas Pro AI

The AI algorithms developed by Trade Ideas are the main reason you want to sign up. I had a lengthy zoom session with Sean Mclaughlin, Senior Strategist over at Trade Ideas, to delve into how the AI works, and I was very impressed. This company is laser-focused on providing traders with the best data-supported trading opportunities. There are currently four AI systems in operation.

Holly is 3 AI Systems Applying Over 70 Strategies Differently.

Holly AI

Holly AI is the original incarnation of the Trade Ideas algorithm. Holly applies 70 strategies to all US & Canadian stock exchanges, including pink sheets and OTC markets. 70 strategies multiplied by 10,000+ stocks means millions of backtests every day. Only the strategies with the highest backtested win rate of over 60% and an estimated risk-reward ratio of 2:1 will be suggested as potential trades the following day.

Holly 2.0

Holly 2.0 is a more aggressive version of Holly AI, presenting more aggressive day trading scenarios for you to choose from. Trade Ideas operates three key trading styles with each AI engine, Conservative, Moderate & Aggressive. Holly 2.0 is an aggressive strategy with higher risk but ultimately higher rewards.

Holly Neo

Holly NEO is a newer AI that seeks to trade real-time chart patterns. It utilizes a mix of four strategies. The Pullback Long strategy seeks to identify trades where the stock price is down and is seeking to start moving up on higher volume. The Breakout Long strategy discovers where stock price breaks out through a key resistance or new highs. The Pullback Short strategy identifies a short pullback opportunity in price. Finally, the Breakdown Short backtested finds shorting opportunity where upward momentum breaks down.

Omni AI is a real-time AI ideas engine combining all of the above strategies into a straight short or long trade recommendation. It is a new development and does not yet have a proven track record, but the performance looks good on viewing the recent trades.

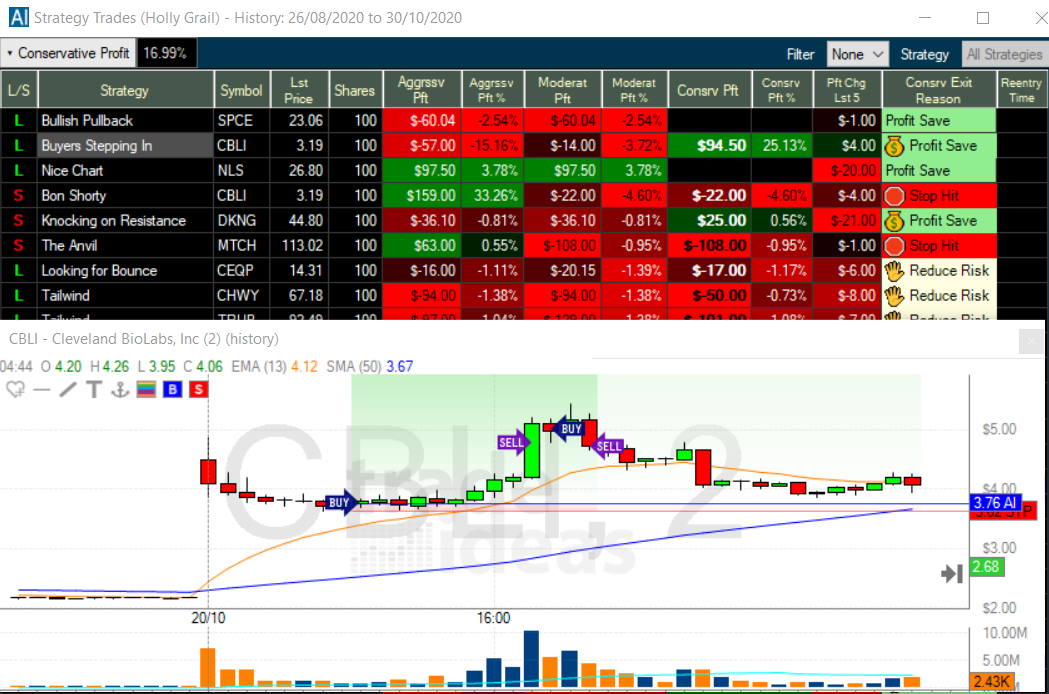

Trade Ideas Buy & Sell Signals

Trade Ideas uniquely shows you every signal buy and sell signal visually on a chart. I have highlighted a trade recommended by Holly AI (Holly Grail) in the chart below. Thchartade for Cleveland Biolabs (Ticker: CBLI) made a 25% profit within 4 hours. Not how the buy and sell signals are depicted on the chart.

The Facts About Trade Ideas Signals

- Trade Ideas has large institutional clients and is a legitimate business; they also partner with Interactive Brokers.

- Trade Ideas recommends, on average, about 3 to 10 trades per day.

- Each trade duration is from a few minutes to a few hours.

- Upon downloading and analyzing 65 days of trades, I can confirm the performance numbers claimed by trade ideas.

- You must be an active day trader to take advantage of Trade Ideas.

- Trade Ideas returns approximately 20% per year.

- Trade Ideas has, in the last two years, beaten the S&P500.

- You must be short and go long to take advantage of the trading strategies.

- Depending upon your leverage, trading style, and the trades you take, you could make more than 20% or even make a loss.

- Trade Ideas is Day Trading Software; you will need to hold a minimum balance of $25K in your brokerage account to actively pattern day trade in the USA.

Trade Ideas AI Backtesting Performance

The claimed Trade Ideas performance is available on their website and is quite impressive. But to judge the performance of any system, we have to compare it to the performance of the underlying benchmark. In this case, I compare $50,000 invested in the S&P 500 versus day trading with Trade Ideas.

| AI Performance | Starting Capital Jan 2019 | Ending Capital Oct 2020 | Return | % Per year |

| Holly Grail (AI) | $50,000.00 | $71,186.00 | 42% | 23% |

| Holly 2.0 | $50,000.00 | $80,510.00 | 61% | 33% |

| Holly Neo | $50,000.00 | $71,186.00 | 42% | 23% |

| S&P 500 | $50,000.00 | $66,000.00 | 32% | 17% |

As you can see, Holly has outperformed the S&P 500 since 2019. Interestingly Holly did not suffer the huge losses incurred in the S&P 500 during the Corona Crash from March to April 2020.

2. Tradingview: Best Backtesting & Auto-trading Globally

TradingView provides excellent free backtesting software for stocks, forex, and cryptocurrencies. With TradingView, you can also auto-trade using webhooks to 3rd parties to their integrated brokers.

TradingView is the ultimate all-rounder, with screening and charting for all stock exchanges globally, plus a community of 13 million active users sharing ideas, strategies, and indicators.

| TradingView Rating | 4.6/5.0 |

| ⚡ Features | Charts, News, Watchlists, Screening |

| 🏆 Backtesting Features | Trading, Flexible Chart Backtesting, Pine Code |

| 🤖 Auto Trading | Yes – Webhooks |

| 🎯 Best for | Stock, Fx & Crypto Traders |

| 🆓 Free Version | TradingView Free |

| 💰 Price | $0-$59/mo |

| 🎮 Trial | Free 30-Day |

| ✂ Discount | -50% Discount |

| 🌎 Region | Global |

There is no doubt about it; I love TradingView and use it daily. I regularly post charts, ideas, and analyses and chat with other traders. Follow me on TradingView. The entire community on TradingView is focused on trading and investing, and the service is first-class.

Pros

- Social First, Chat, Publish, Follow

- Easy Backtesting & Development With Pine Script

- Strategy Tester Manual Backtesting

- Global Exchange Data

- Backtesting for Cryptocurrency, Forex & Stocks USA & Globally

- 13 Million Active User Community

Cons

- No Real-time News

- Backtest Only Single Instruments, Not Entire Markets

Video: Backtesting With TradingView

TradingView’s Free Backtesting Software

The best free backtesting software is TradingView which allows users of their free plan to backtest Stocks, Crypto & Forex. TradingView’s pine script engine enables powerful and flexible chart backtesting for up to 100 years of market data.

TradingView has an active community of people developing and sharing stock analysis systems, and you can create and sell your own with the Premium-level service. Also, there are many indicators and systems from the community for free.

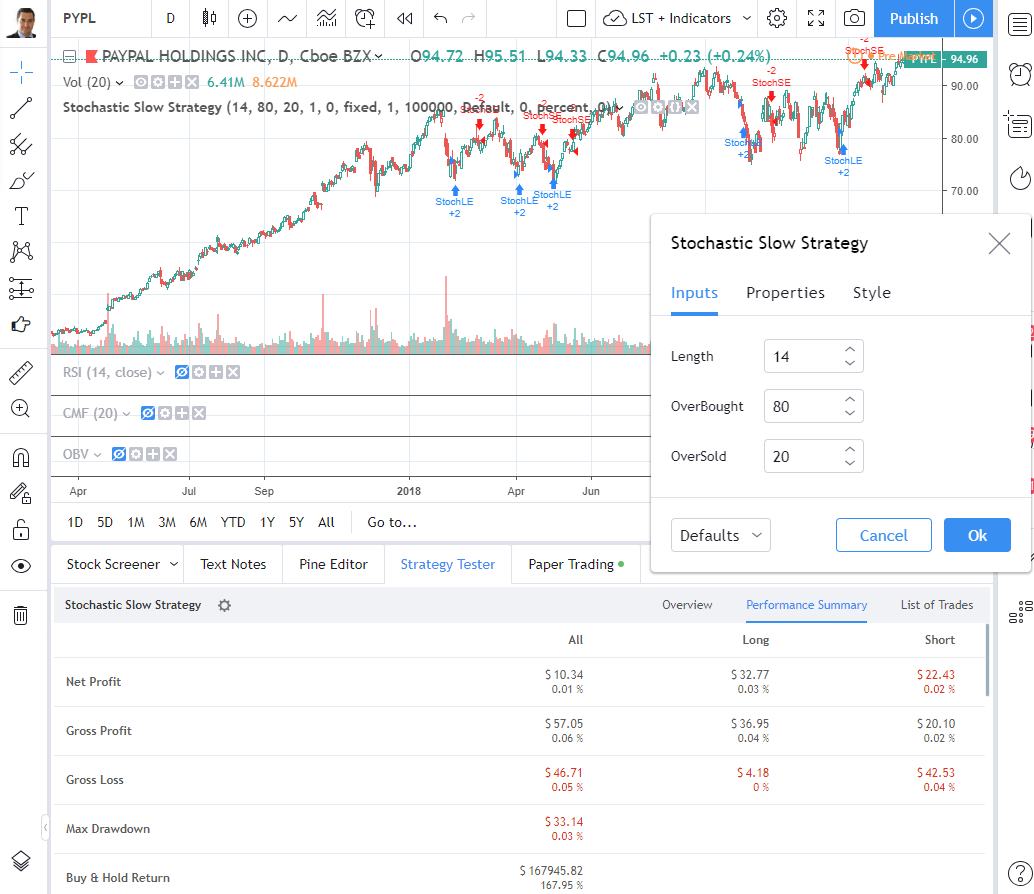

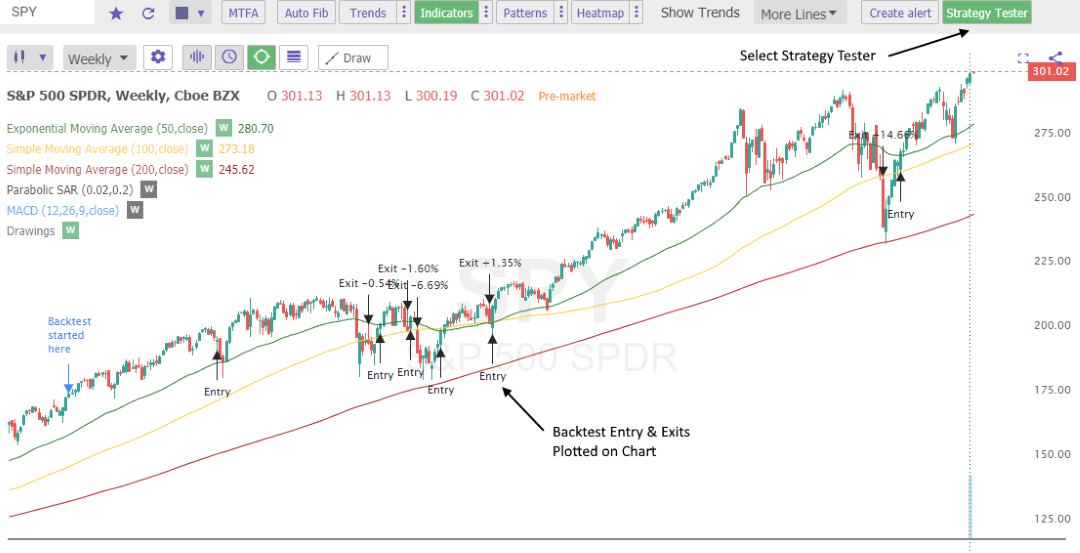

They have implemented backtesting straightforwardly and intuitively. In the image below, I have implemented an in-built strategy called “Slow Stochastics,” which initiates a trade when the stochastics indicators are oversold and sells when stochastics is overbought.

I like that you have results in a few clicks [Strategy Tester -> Add Strategy]. You can also tweak the strategy parameters, as you can see below, and observe the results.

The TradingView backtesting results reporting is good. The system shows you the profit performance of the strategy, including net profit, drawdown, buy & hold return, % profitable trades, and the number of trades. Also, all the trades are plotted on a chart for valuable visual reference.

I have even implemented my Stock Market Crash Detector strategy into TradingView; I am no developer, but the Pine Script language is so natural anyone can do it.

Auto Trade with TradingView

It is possible to set up auto trading in Tradingview using the webhooks URL option in your alerts menu. Capitalise.ai attempt to make this process more robust using its specialized webhook engine. Watch this video to find out more.

Tradichartw Market Replay

TradingView also has a market replay functionality enabling you to play through the timeline. This shows you the chart scrolling and the trades executed; it is simple yet powerful to use. All buy and sell orders are drawn on the chart and highlighted. All in all, this is a great package that is included in the free version.

The only thing you cannot do is forecast and implement Robotic Trading Automation, but that is typically what broker-integrated backtesting tools perform.

Pricing & Software

You can have TradingView for free; it is a winner of our Best Free Charting Software Review. However, there are limitations. I recommend going for the PRO+ at $19 per month or the Premium at $39 per month; the benefits are extensive, including priority customer support and unlimited everything. Also, a huge benefit is that the data speed and coverage are mind-blowing, covering literally every stock market on the planet and not just stocks but ETFs, mutual funds, futures, forex, bonds & cryptocurrencies AT NO EXTRA COST.

TradingView Platform Analysis

Trade Management. With TradingView, you get full broker integration, you can place trades on charts, and it will take care of profit & loss reporting and analysis for you. The only thing it does not cover is Stock Options trading.

Fundamental Scanning & Screening. It is a perfect 10 for TradingView as they hit the mark on real-time scanning, filtering, and fundamental watchlists. The list of fundamentals you can scan & filter on is genuinely huge. Any idea you have based on fundamentals will be covered.

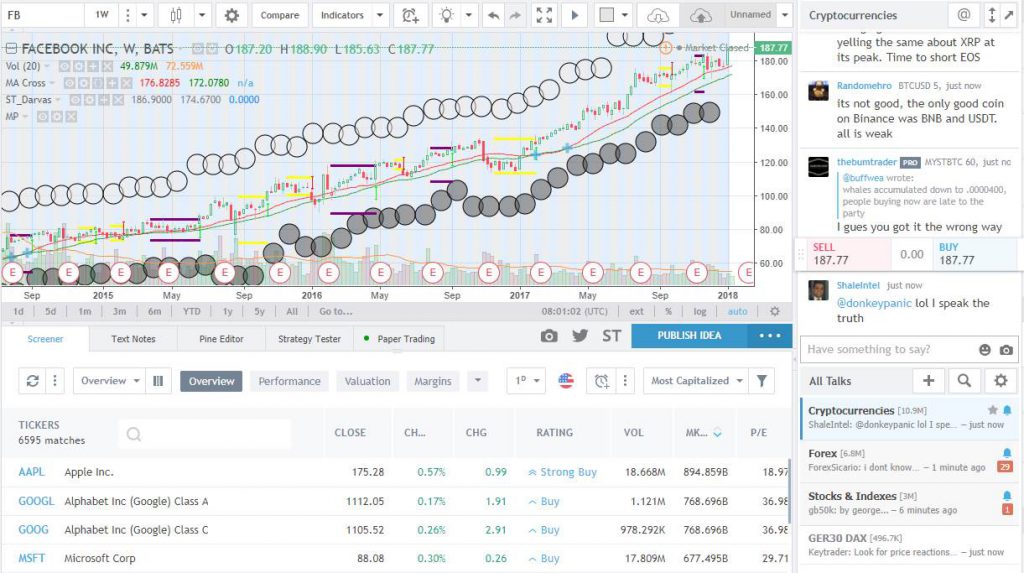

News & Social Community. As soon as you connect to TradingView, you realize this is also developed for the community. You can look at community ideas, post your charts and ideas, and join limitless numbers of groups covering everything from Bonds to Cryptocurrencies. You can connect with other traders, read their ideas, be inspired, and chat. It is simply the best socially integrated trading platform on the planet. The news feeds are fully integrated, including Kiplinger, DailyFX, Futures Magazine, FXStreet, and StockTwits. Add that to the social network, and you have a great solution.

Connect with me on TradingView it’s free

Technical Analysis & Charts. With over 160 different indicators, and unique specialty charts such as LineBreak, Kagi, Heikin Ashichartnt & Figure, and Renko, you have everything you will need as an advanced trader. With the Premium membership, you also get Level II insight, fully integrated.

TradingView Backtesting Summary

TradingView is a great way to kick off your life as a backtesting system developer. There is a vast selection of free and premium strategies to test and the biggest and most active community of traders on the planet. TradingView has it all. I would recommend going for the Pro or Pro Plus subscription as they enable more charts, indicators, and views, including intraday market data, which you might need for your backtesting.

How to Get 16% to 60% Epic Discounts on TradingView Pricing Plans

3. TrendSpider: Best Backtesting, Pattern Recognition & Auto-trading

TrendSpider provides a no-coding system for backtesting, and you can auto-trade using webhooks on alerts. This means you simply point-and-click for backtesting charts and indicators. With TrendSpider, you can even select a 1-minute timeframe for intraday backtesting. Trend

TrendSpider has fully automated AI-driven trendlines, Fibonacci, and multi-timeframe analysis for stocks, forex, crypto, and futures. Add a robust backtesting engine, and you have a great technical analysis platform.

| TrendSpider Rating | 4.5/5.0 |

| ⚡ Features | Charts, Watchlists, Screening |

| 🏆 Backtesting Features | AI Automated Pattern Recognition, Candlestick, Trendlines |

| 🤖 Auto Trading | Yes – Webhooks |

| 🎯 Best for | Stock, Fx & Crypto Traders |

| 💰 Price | $44-$131/mo |

| 🎮 Trial | Free 7-Day |

| ✂ Discount | -40% Use Coupon Code “LIB40” |

| 🌎 Region | USA |

Pros

- Automated Trend Line Detection

- Automatic Multi-TimeFrame Analysis

- Simple & Powerful Backtesting

- Real-time Exchange Data Included in Price

- Automatic Fibonacci Trend Detection

- Stocks, ETFs, Forex, Crypto, Indices & Futures

Cons

- No Auto Trading

- No Social

The TrendSpider team is innovating at breakneck speed, and the features they are innovating are unique to the industry.

Trend Spider Backtesting

TrendSpider takes a different approach to backtesting. Because the platform is built from the ground up to automatically detect trendlines and Fibonacci patterns, it already has backtesting built into the heart of the code.

The highest probability trendlines are automatically flagged, and you can adjust the algorithm’s sensitivity,y that controls the detection to show more or fewer lines.

TrendSpider has implemented a strategy tester that allows you to type what you want to test freely, and it will do the coding for you. It is a smooth and simple implementation that is incredibly user-friendly. There is also the ability to adjust your backtest conditions on the fly, and the “Price Behaviour Explorer” and “System Performance Chart” automatically update.

You can jump into coding if you want to, but the key here is that you do not have to.

Integrated backtesting of automated trendlines, showing win rate, profitability, and drawdown, is a new addition and warmly welcome; the team is propelling TrendSpider into one of the leading technical analysis packages in the industry.

TrendSpider has an excellent price starting at $27 per month, including real-time data. They have also expanded to cover Forex, Crypto, ETFs, and Futures, which means you can apply the stunning Auto Trend-lines and Multi Time-Frame Analysis on many different markets. The platform is built on HTML 5 and needs Zero installation and Zero data feed configuration.

The system runs on all platforms, from smartphones to PCs. Finally, I have tested the customer support and confirmed it is excellent, and you have a human to chat with whenever you like.

Auto Trade with TrendSpider’s Trading Bot

If you are a serious market analyst, then TrendSpider will help you do the job quicker, with better quality, and help you not to miss an opportunity.

Automated trendline detection and plotting do a better job than a human can; using algorithms, the system can detect thousands of trends-lines and flag the most important ones with the highest backtested probability of success.

The multi-timeframe analysis means you can view multiple timeframe charts on a single chart with the trendlines plotted automatically. Another great feature is the advanced plotting of support and resistance lines into a subtlely integrated chart heatmap.

Finally, Raindrop Charts are a unique and intuitive way to visualize volume profile or volume at price action.

4. Stock Rover: Best Backtesting Software for USA Investors

Stock Rover is my favorite backtesting software for value, growth, and dividend investors. I built my Beat the Market growth stock system using Stock Rover’s backtesting capability and excellent 10-year financial database.

| Stock Rover Rating | 4.5/5.0 |

| ⚡ Features | Charts, Powerful Screening, Research, Portfolio Mgt, Broker Integration |

| 🏆 Backtesting Features | 10-Year Historical Financial Data, Fundamental Backtesting |

| 🤖 Auto Trading | No |

| 🎯 Best for | Growth, Dividend & Value Investors |

| 🆓 Free Version | Stock Rover Free |

| 🎮 Premium Trial | Free 14-Day |

| ✂ Premium Discount | 25% During Trial Period |

| 🌎 Markets Covered | USA |

Stock Rover Pros

- 650+ Financial Screening Metrics

- Potent Stock Scoring Systems

- Unique 10-Year Historical Data for Backtesting

- Warren Buffett Value Screeners & Portfolios

- Real-time Research Reports

Stock Rover Cons

- No Social Community

- Not Recommended for Traders

Stock Rover Backtesting

Stock Rover provides ten years of backdated financial information and scanning possibilities, better than nearly every other stock screening package. What is unique is that you can backtest screening results.

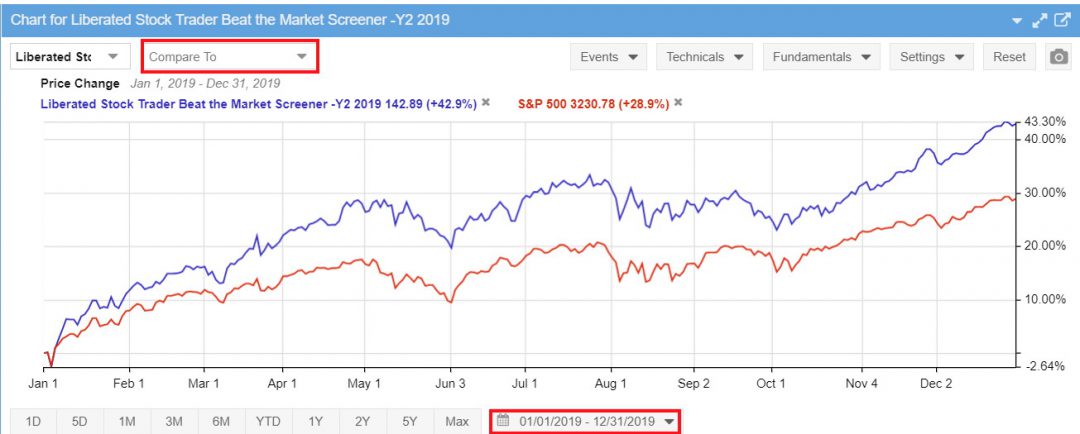

Below I share the “Beat the Market Screener Backtest,” which focuses on growth and financial stability. I was able to backtest the strategy for the previousseven7 years using Stock Rover.

The Liberated Stock Trader Beat the Market Screener seeks to select stocks with a significant chance of beating the S&P500 returns. The screener uses growth in free cash flow and explosive EPS growth. Combining this with Joel Greenblatt’s ROC and Earnings Yield formulas, “the Magic Formula,” we have a selection of stocks that beat the market 7 of the last 8 years.

This work has been made possible due to the team’s fabulous work over at our partner Stock Rover, who has created a stock research and screening platform that won our in-depth Best Stock Screener Review for the last two years.

Why is Stock Rover so special in creating superior stock screeners? Because Stock Rover maintains a clean 10-year historical database of hundreds of vital ratios, calculations, and metrics. This means you can travel back in time to test if your stock selection criteria have worked in the past.

This Liberated Stock Trader Beat the Market Screener (LST BTM) is built into the Stock Rover library and is available to all Stock Rover Premium Plus Subscribers.

Beating the Market With Stock Rover?

To beat the market means that your stock investments will need to outperform the underlying index of stocks. The market to beat is generally the 8% annual return of the S&P500 index in the USA. Anyone could beat the market in a single year, but the key challenge is outperforming the market over the long term.

Beating the market is nirvana for every investor, but many investors realize it can be tough to outperform the stock market’s returns year after year.

Beat the Market Backtest Performance.

| 8 Year Performance | S&P500 % Gain Jan 1st to Dec 31st | LST Beat the Market Screener % Gain | Result |

| 2013 | 29.8% | 49.4% | Beat |

| 2014 | 11.4% | 16.9% | Beat |

| 2015 | -0.7% | 2.6% | Beat |

| 2016 | 9.5% | 23.2% | Beat |

| 2017 | 19.4% | 37.4% | Beat |

| 2018 | -6.2% | -24.9% | Lost |

| 2019 | 28.9% | 46.8% | Beat |

| 2020 | 18.4% | 51.8% | Beat |

| Average Yearly Return | 13.8% | 25.4% | Beat |

How to Beat the Stock Market With Stock Rover

I love Stock Rover so much that I spent 2 years creating a growth stock investing strategy that has outperformed the S&P 500 by 102% over the last eight years. I used Stock Rover’s excellent backtesting, screening, and historical database to achieve this.

This Liberated Stock Trader Beat the Market Strategy (LST BTM) is built exclusively for Stock Rover Premium Plus Subscribers.

5. MetaStock: Best Chart Backtesting & Forecasting

MetaStock is one of the best independent, broker-agnostic, stock backtesting, and forecasting software platforms. MetaStock enables over 300 chart indicator backtesting strategies.

| MetaStock Rating | 4.4/5.0 |

| ⚡ Features | Charts, Watchlists, Scanning |

| 🏆 Backtesting Features | Forecasting, Technical Chart Backtesting |

| 🤖 Auto Trading | No |

| 🎯 Best for | Stock & Fx Traders |

| 💰 Price | $59-$250/mo |

| 🎮 Trial | 30-Day Free Trial |

| ✂ Discount | 3 Months for 1 |

Pros

- Develop Sophisticated Systems & Backtest Entire Markets In 1 Click

- Great Backtesting Profit, Draw-down & ROI Reporting

- Exceptional & Intuitive Forecasting Software

- Number 1 For Charts, Indicators & Real-Time News

- Excellent Customer Support & Educational Seminars

- All Global Markets Covered + Broker Independent

Cons

- Scripting Skills Required

- No Automated Trade Execution

MetaStock Backtesting

MetaStock enables backtesting over 300 chart, price, and volume indicators, enabling the development of an extremely granular trading strategy for stocks, forex, and commodities.

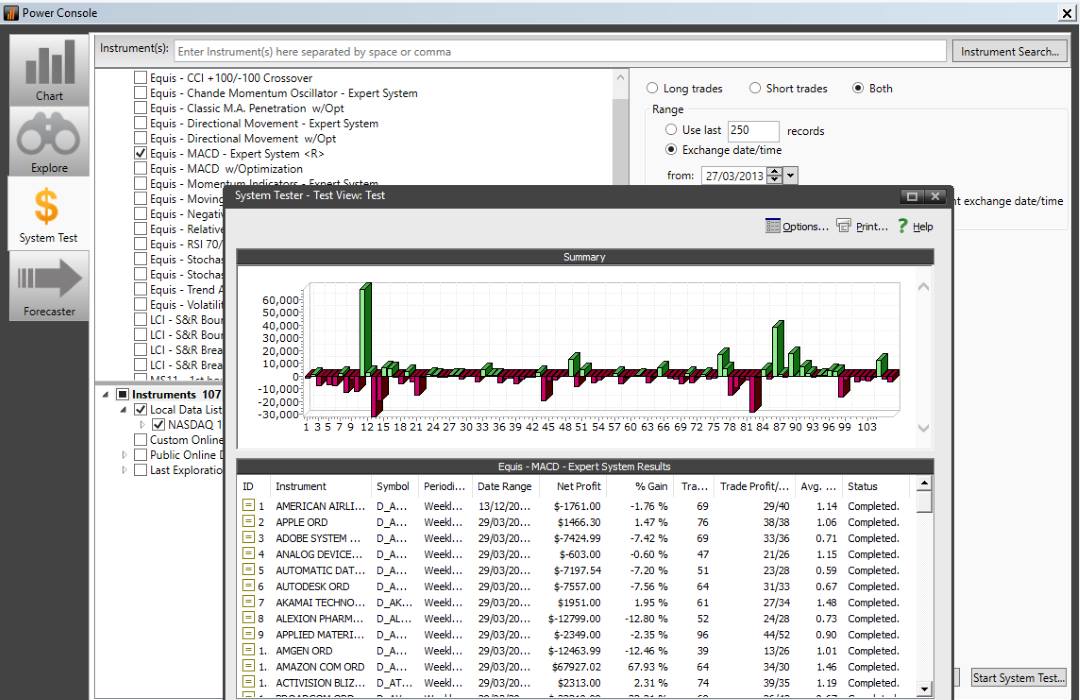

As you launch MetaStock, you are presented with the Power Console, enabling you to select what you want to do quickly. Select System Test, and you will have access to 58 different systems you can backtest. I selected the Equis MACD Expert System in the example below and ran it on the entire Nasdaq 100.

After 60 seconds, the backtest was completed and presented me with a list of every buy or sell trade and the drawdown on the portfolio chart that you can see above. You can click through to any trade to see the background of the trade, the size of the trade, duration, and profit or loss.

MetaStock harnesses many inbuilt systems and Expert Advisors to help you as a beginner or intermediate trader understand and profit from technical analysis patterns and well-researched systems. This is a crucial area of advantage.

Of course, the inbuilt systems will not make you super-rich, so you will want to backtest and develop your own profitable system. You can build a unique, backtested strategy with MetaStock with some scripting or programming skills. If you do not have the required skills, you can ask MetaStock or one of a considerable number of MetaStock Partners to assist you in creating your system.

Their partners sell many premium stock trading systems for MetaStock and are usually backed up with training and webinars to support the clients.

Fundamental Scanning and Screening

MetaStock is a partner of Refinitiv, the biggest provider of real-time news and market analysis. Refinitiv was purchased by the London Stock Exchange for $27 billion, primarily for its incredible database of global financial data, not just on companies but countries, economies, and industries.

With the MetaStock Refinitiv service, the data filtering and scanning possibilities are vast. MetaStock Refinitiv provides an incredibly in-depth analysis of company fundamentals from debt structure to top 10 investors, including level II market liquidity. MetaStock is highly rated with excellent watchlists featuring fundamentals and robust scanning of the markets.

MetaStock Forecaster Capability

The most significant addition to the MetaStock arsenal is the forecasting functionality, which sets it apart from the crowd. By selecting Forecaster from the power console, you can choose one or more stocks, ETFs, or forex pairs and click forecast. You are then presented with an interactive report which enables you to scan through the many predictive recognizers, which help you understand the basis for the prediction and the methodology. This is a powerful forecasting implementation.

You can even use artificial intelligence functionality to test a set of variables within your backtesting. You could, for example, test if the price moves above the moving average of 10,14,18 or 20 in a single test to see which of the moving averages best work with that stock.

Watch this video from my partner Hunter Smith over at MetaStock to learn more about MetaStock forecasting.

MetaStock Backtester/Forecaster Video

Try MetaStock With a 3 Months for 1 Month Deal

MetaStock is one of the few vendors that take forecasting exceptionally seriously. The system backtesting is excellent because it allows you to test if a theory, idea, or set of analyses has worked in the past. Forecasting takes it to a whole new level by playing forward the backtesting to see how successful you might be with a strategy under certain circumstances. The configurable nature of the reporting for both backtesting and forecasting results is powerful.

Technical Analysis & Forex Forecasting

Forex forecasting based on sentiment is an exceptional feature. Never mind the broadest selection of technical analysis indicators on the market today. MetaStock is the king of technical analysis, warranting a perfect rating.

MetaStock covers all the core chart types and includes Point & Figure, Equivolume, and Market Profile charts. When it comes to indicators, MetaStock has 300+ different types, including Darvas Box and Ichimoku Cloud. MetaStock will also help you develop your indicators based on their coding system.

MetaStock Backtesting & Forecasting Summary

For backtesting and forecasting, MetaStock is one of the best services available. My recommendation for an investor or trader is to combine the MetaStock & Refinitiv Xenith Packages. The depth of fundamental research and news in Refinitiv Xenith is staggering, and the in-depth analysis, backtesting, and forecasting in MetaStock is industry-leading.

You have other options if $199 per month for the Refinitiv Xenith + MetaStock package is too much. If you simply want the end-of-day data and all the MetaStock functionality for backtesting & forecasting, the price starts at $69 per month for MetaStock D/C. You can even buy one-off licenses if you prefer.

6. Tickeron: Backtesting, AI Signals & Pattern Recognition

Tickeron’s backtesting is automated and has impressive AI-powered chart pattern recognition and prediction algorithms for stocks, ETFs, Forex, and Cryptocurrencies. Tickeron excels at providing thematic model portfolios and specific pattern-based trading signals combined with success probability and AI confidence levels.

| Tickeron Rating | 4.4/5.0 |

| ⚡ Features | Portfolios, Watchlists, Screening, AI Portfolios |

| 🏆 Backtesting Features | AI Trade Signals, 40 Chart Patterns Recognized, Trend Prediction Algorithms |

| 🤖 Auto Trading | No |

| 🎯 Best for | Investors & Traders USA |

| 💰 Price | $0-$250/mo |

| 💻 OS | Web Browser, PC |

| 🎮 Trial | 14-Day Free Trial |

| ✂ Discount | -50% Off All Annual Plans |

Tickeron’s trading platform is unique and innovative, combining artificial intelligence and human intelligence based on the community of traders, so you can compare what the humans think versus the machines.

Pros

- 45 Streams of Trade Ideas

- 40 Real-time Stock, ETF, Forex & Crypto Pattern Recognition

- AI Trend Prediction Engines

- Build Your Own Portfolios with AI

Cons

- Custom Charting Limited

- Cannot Plot Indicators

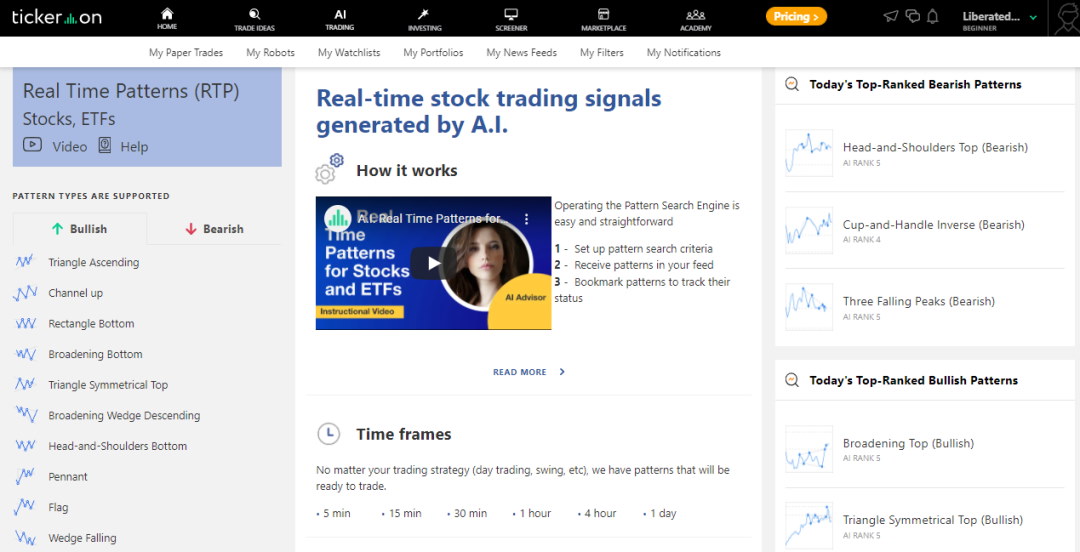

Tickeron targets day traders, swing traders, and investors with an intricate lineup of features and benefits specific to your investing style. Tickeron uses AI rules to generate trading ideas based on pattern recognition. Firstly they use a database of technical analysis patterns to search the stock market for stocks that match those price patterns using their pattern search engine. Of course, each detected pattern has a backtested track record of success, and this pattern’s success is factored into the prediction using their Trend Prediction Engine.

To understand the platform, we first need to consider the pricing structure and what you get for your money.

Pattern Recognition & Prediction With Backtesting

At the heart of Tickeron is the ability of its AI algorithms to spot 40 different stock chart patterns in real time. You can select which pattern you want to trade, and it will filter stocks, forex, or cryptocurrencies that currently show the pattern. Patterns are split into bullish patterns for long trades or bearish patterns for those who wish to go short.

Tickeron’s real-time pattern recognition is particularly useful for swing or day traders, where market timing is the top priority. Tickeron also can scan the entire market and suggest which patterns are working best on a particular day. In the screenshot above, you can see “Today’s Top Ranked Patterns,” which rates the potential success of the patterns based on the market’s current trading activity.

Ultimately pattern recognition saves pattern traders a lot of work hunting for potential trade setups because it does all the work for them.

Trading Signals & Prediction

Tickeron has implemented a powerful feature called AI Confidence level. Based on the history of the stock, the success rate of a particular pattern, and the market’s current direction, Tickeron can assign a confidence level to a trade prediction.

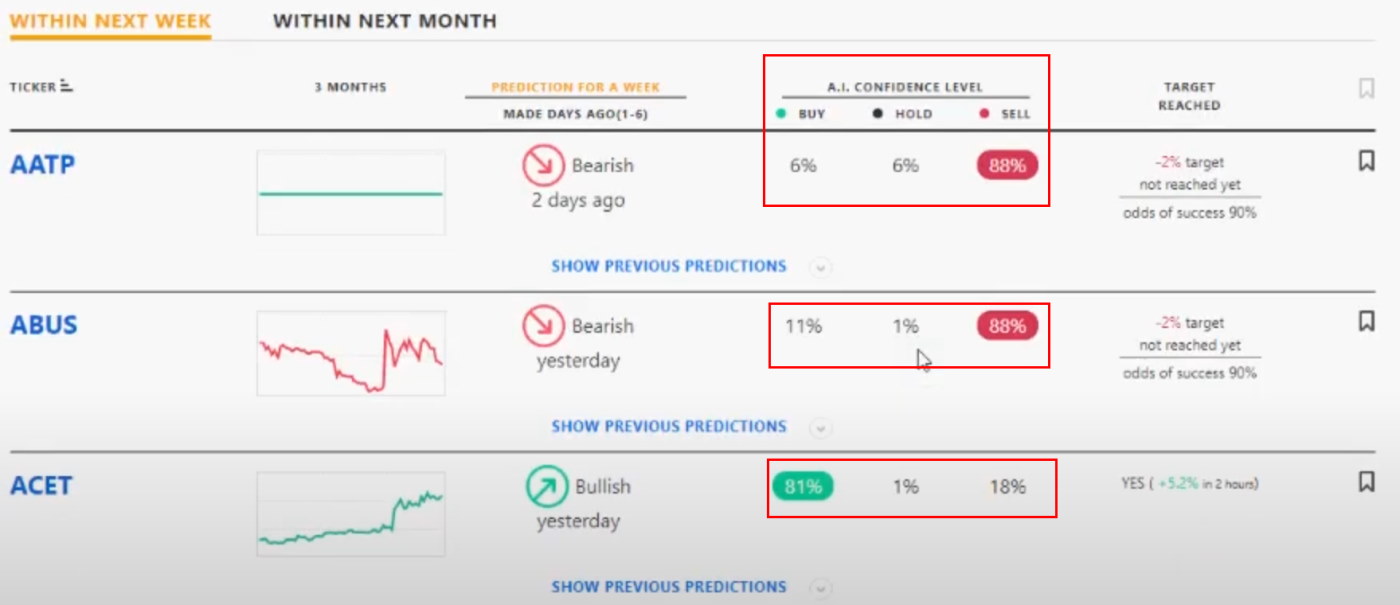

The screenshot below shows that the Tickeron AI predicts that ABUS has an 88% chance of declining in value and ACET has an 81% chance of increasing in value.

The outstanding feature of the Tickeron prediction engine is that you can simply click “Show previous predictions” to check if the Ai has done a good job in the past with a particular pattern on specific stocks. The prediction engine provides the right level of clarity and granularity so you can make informed trading decisions.

Tickeron is worth buying if you are a short-term trader because it provides high probability AI-backtested trade signals. I recommend a trading account value of over $25K for active pattern day trading.

7. Portfolio123: Stock Backtesting & Research for Investors

Testing of Portfolio123 shows stock screening and powerful backtesting software with a robust financial database and integrated commission-free trading with Tradier. Portfolio123 can be used by income, value, and growth investors but is also advantageous for swing traders.

| Portfolio123 Rating | 4.4/5.0 |

| ⚡ Features | Screening, Research, Pre-built Model Screeners, Integrated Free Trading |

| 🏆 Backtesting Features | 10-Year Backtesting Engine, 470+ Screening Metrics |

| 🤖 Auto Trading | No |

| 🎯 Best for | Experienced USA Investors |

| 💰 Price | $0-$83/mo |

| 💻 OS | Web Browser |

| 🎮 Trial | 21 Days for $9 |

Portfolio123 covers stocks, fixed income, and ETFs on US & Canadian exchanges, so it is unsuitable for international stock investors. With Portfolio123, you can design a real-time trading strategy, fully automated with a broker, that will hold the stocks that pass your screen and sell those that don’t.

Pros

- 470+ Screening Metrics

- 10-Year Backtesting Engine

- Unique 10-Year Historical Data

- Pre-built Model Screeners

- 260 Financial Ratios

- Integrated $0 Trading

Cons

- No Integrated News

- No App for Android or iPhone

- Initially Complex To Use

- Technical Analysis Charting Needs Improving

The Portfolio123 screener allows you to filter 10,000+ stocks and 44,000 ETFs to help you find the investments or trades that match your exact criteria. Portfolio123 also has ranked screening which enables you to rank the stocks that best match your criteria, filtering a list from hundreds of stocks to a handful. You can also define your custom universes, setting the macro criteria for which stocks are included in the sample.

Most ideas based on fundamentals will be covered with over 225 data points. Portfolio123 has 460 criteria, including analyst revisions, estimates, and technical data.

You can also use Portfolio123 to screen stocks on their performance relative to the S&P500 or any other benchmark. You could develop a strategy to select stocks based on their historical performance versus the market.

The number of factors available for screening is impressive. Not only can you screen based on reliable information from a company’s financial reports, but you can access technical factors, create your factors using period and announcement dates, eliminate stocks with high bid-ask spreads, limit your screen to stocks in a certain industry, or sector, rank factors against other stocks in an industry or sector, and change your factor balance depending on economic conditions.

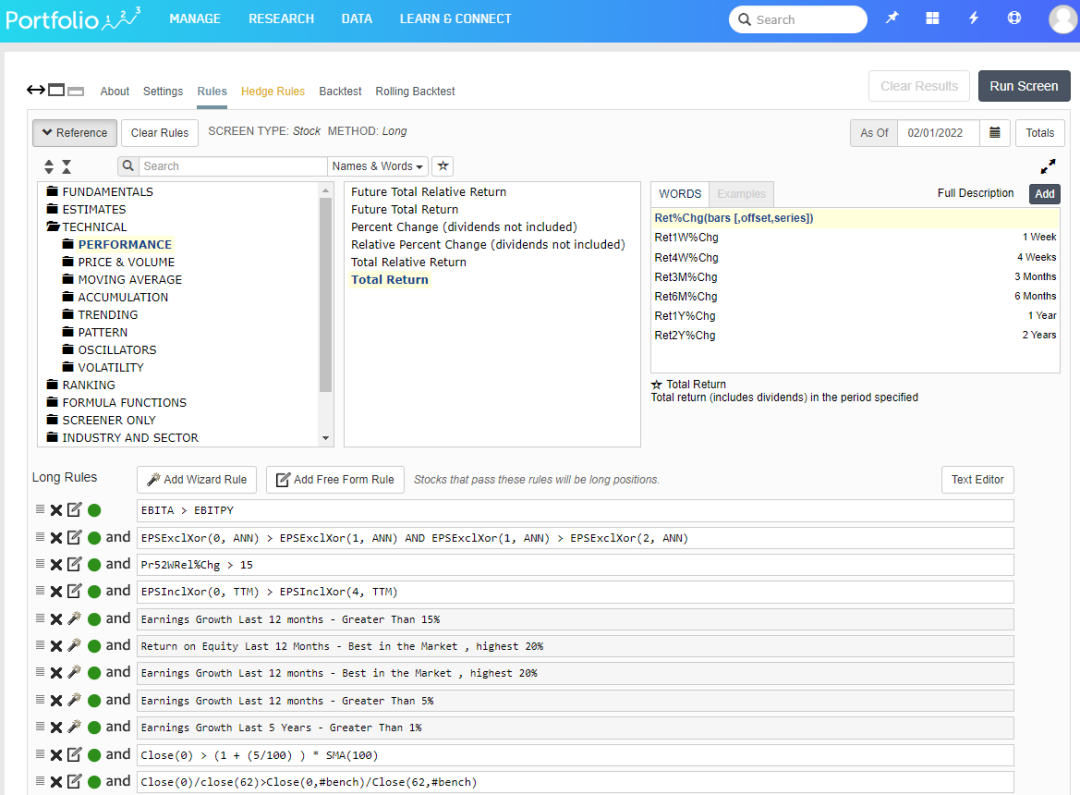

Building your Portfolio123 screener is theoretically easy; select Research -> Screens, and you can start to play. No programming skills are required to build a Portfolio123 screener, but basic coding will certainly help. If you want to create more powerful screening rules, you will need to spend significant time studying the coding logic and understanding the proprietary criteria names.

Portfolio123 Backtesting

Portfolio123’s backtesting engine is where the software shines. Expertly implemented, fast, and extremely configurable, Portfolio123 has the best backtesting service for people serious about testing fundamental strategies.

Portfolio123 enables you to be very granular in setting up your backtest with entry rules, slippage, weighing, rebalance frequency, and custom timeframes.

The Portfolio123 screener is built to make users test not just pre-built concepts but all sorts of hypotheses. You can use your own universe, rank with your multi-factor rank, and run backtests or rolling backtests.

The Portfolio123 screener relies on great data, and they have worked hard to overcome the pitfalls of financial data, such as N/A numbers in sparse preliminary reports. Our pre-built factors handle N/A’s efficiently and use alternate algorithms to produce the best possible result. Great data isn’t an overnight project; they’ve been working on data since 2004.

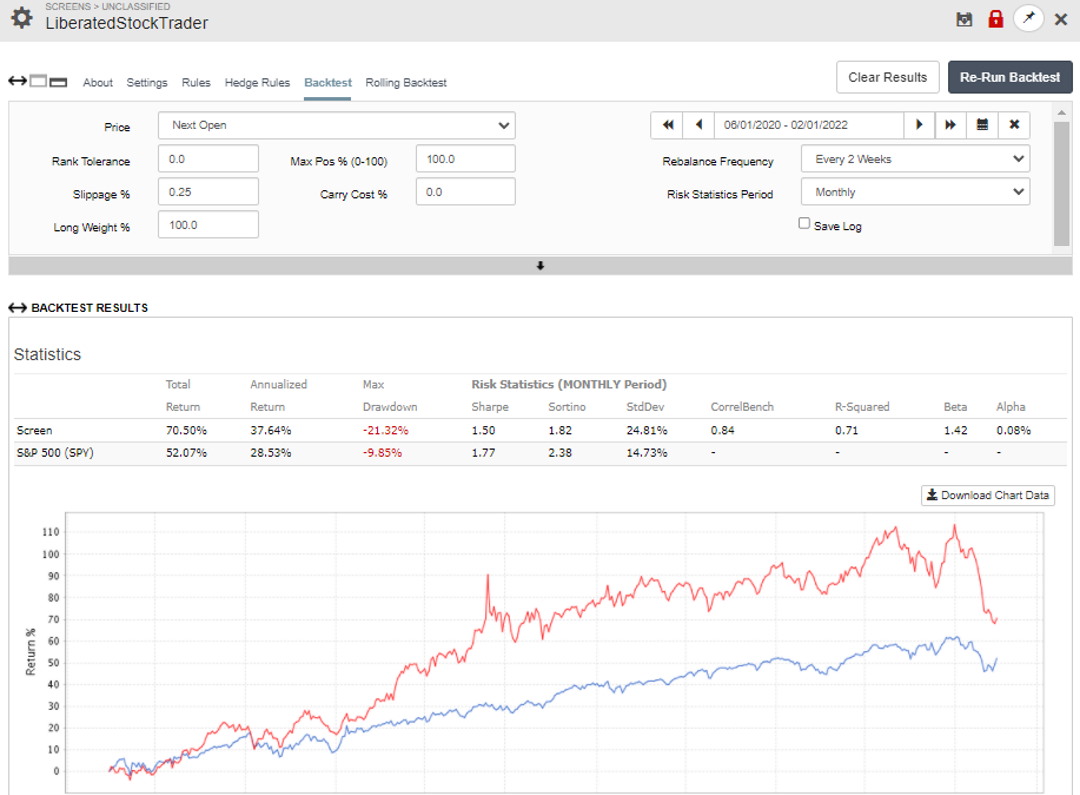

The image below shows the LiberatedStockTrader screener I developed in the previous section. I backtested the screener for two years to see how it performed historically. My screener beat the market in this timeframe, returning 70.5%tos the S&P500’s 52%.

Pre-Built Screeners

Portfolio123 has over 76 pre-built screeners that you can import and use. You need the Screener subscription plan service to take advantage of this. I have personally reviewed many of them, and they are very thoughtfully built. One of my favorites is the “Small Cap Winners” screener.

The Small-Cap Winner strategy had a 5-year return of 189% versus the Russell 2000 return of 58%, very impressive.

The Small-Cap Winner strategy “attempts to balance growth, value, quality, and sentiment factors, using ones that have worked well for small-cap stocks. It has high turnover as it relies greatly on the most recent quarterly earnings announcements and, via sentiment ranking, analyst estimates and recommendations”.

Portfolio123 is an excellent screening and backtesting platform ideal for swing traders and medium-term growth investors. An incredible selection of fundamental criteria, a 20-year financial database, plus the most powerful financial backtesting engine makes Portfolio123 a great choice for experienced stock system developers.

7. Interactive Brokers: Fundamental Portfolio Backtesting

Ideal for active investors and day traders seeking low trading costs and direct global market access. IB alsohase backtesting and auto-trading 3rd party software using capitaise.ai.

| Interactive Brokers Rating | 4.2/5.0 |

| ⚡ Features | Low-Cost Stock & Option Trades Globally |

| 🏆 Backtesting Features | Portfolio Manager for Fundamental Backtesting |

| 🤖 Auto Trading | Yes – Capitalise.ai |

| 🎯 Best for | Investors |

| 💰 Cost Per Stock Trade | $0-$1 |

| 💻 Platform | Web/Mobile |

Pros

- The Best Fundamental Backtesting In The Industry

- Great Trading Platform

- Direct Market Access

- All Markets & Vehicles

Cons

- You Must Be An IB Client

- Limited Backtesting On Chart Indicators & Supply / Demand

Interactive Brokers provides direct market access for fast execution and best-in-class margin costs. They are the grandfather of online discount brokers. Not only are they a long-established company, but they are also large.

It has a complete set of services, enabling you to trade practically anything on any market, Stocks, Options, ETFs, Mutual Funds, Bonds, Foreign Exchange, and even Futures and Commodities. Usually, when a company is well established, it loses its competitive edge. Not so with Interactive Brokers

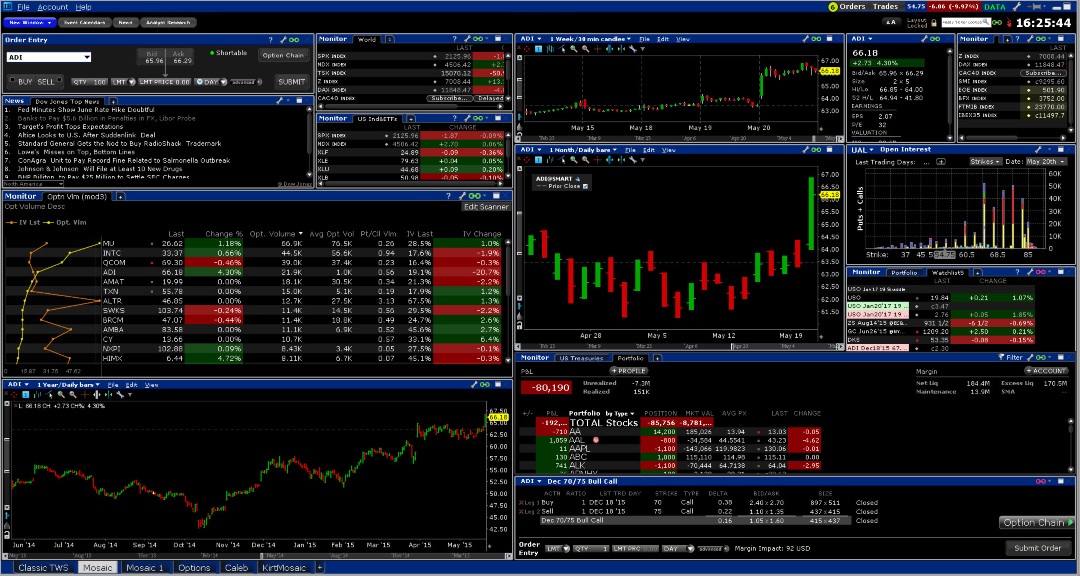

Interactive Brokers Trading Platform

Interactive Brokers has a unique trading platform based on Trader Workstation (TWS). It is free to download and use as a client, and it is the single place to trade any and every one of the vehicles on offer from IB. It caters to everything Stocks, Options, Futures, Forex, Bonds, Mutual Funds & ETFs.

Not only that but there are also a considerable number of advanced add-on tools that plug into TWS, such as:

- ChartTrader – for trading directly from charts.

- Continuous Futures – for commodity futures scanning and analysis.

- DepthTrader – for in-depth analysis of market liquidity.

- OptionTrader – deeper Options Analysis with specific Options strategies.

- ProbabilityLab – to test the Probability Distribution of a particular trade

- Portfolio Manager – for backtesting.

In total, there are 27 different advanced trading tools to suit every possible approach to the market.

Backtesting With Interactive Brokers’ Portfolio Manager

The “Portfolio Manager” tool within the powerful Trader Workstation (TWS) platform is well-designed and easy to use. It is designed to help portfolio managers balance and manage a portfolio of stocks. Most portfolio managers are not buying and selling shares based on technical indicators like MACD, RSI, or Moving Averages; they are buying and selling based on the fundamentals of a particular company. This is reflected in the unique parameters available.

You can choose a portfolio to backtest based on nearly all critical fundamentals, such as P/E, EPS growth, and even Analyst ratings. It is unique and powerful. I enjoyed setting up my portfolio and testing the different scenarios, such as buying low P/E stocks with high analyst ratings from Zacks or high EPS growth stocks with small insider ownership.

Interactive Brokers are a unique broker with a robust portfolio of tools.

Configuring Backtesting With Interactive Brokers

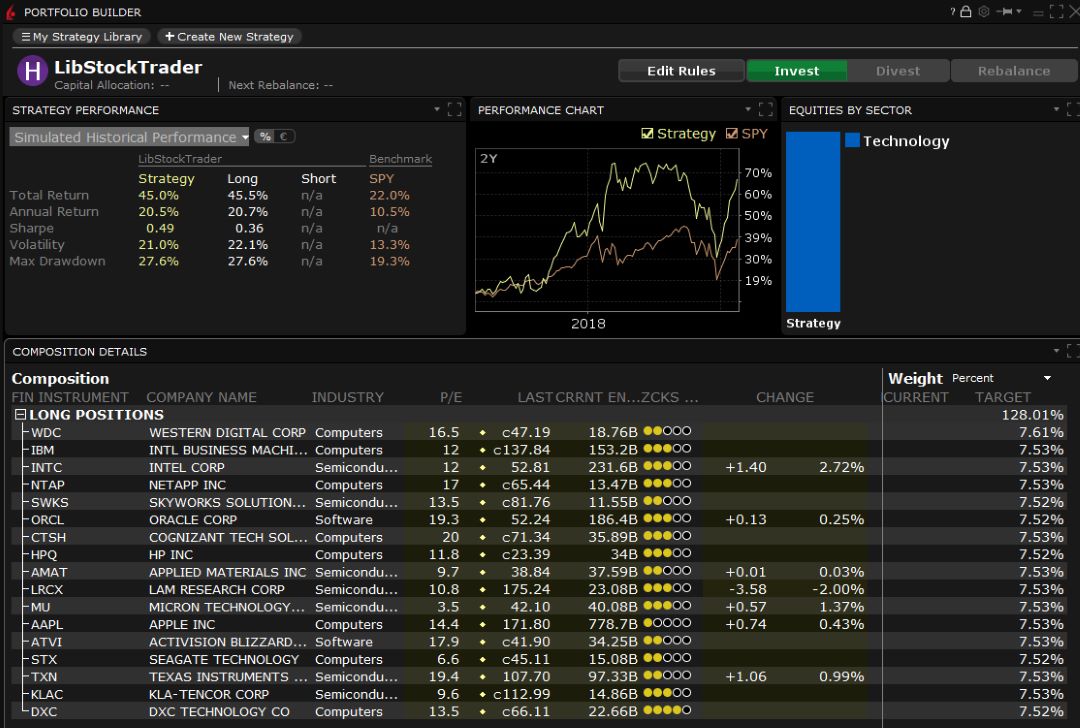

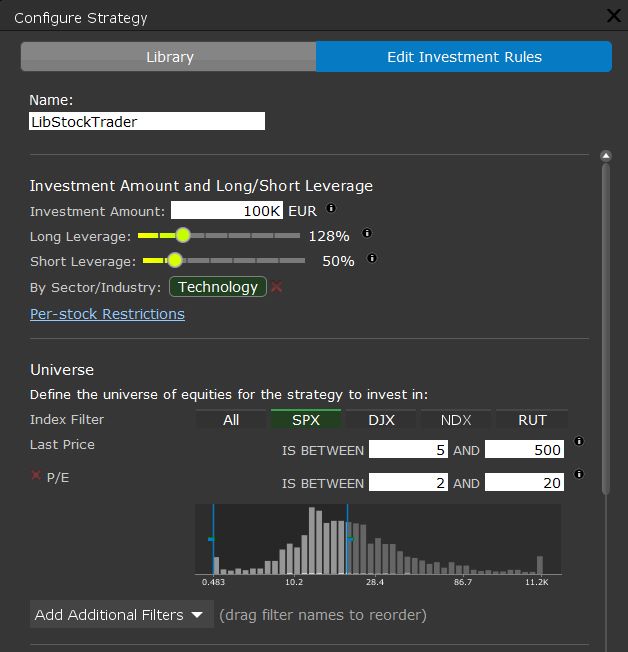

In this basic backtest, I selected stocks between $5 and $500 and a low price-earnings ratio (P/E) of between 5 & 20. I used 128% leverage on my long trades and 50% on short trades and only targeted the technology stocks on the S&P500.

Below you can see the “Add Additional Filters” dropdown menu, where you can consider and test a wealth of factors.

The testing worked out positively (as you can see from the image above), beating the market by 31%, but mostly because of the leverage factor, which, of course, introduces increased risk.

It is a positive playground to test your wildest hypotheses against reality regarding investing rules. Value investors take note; this is a great tool.

IB Backtesting Video

Interactive Brokers (IB) Backtesting Summary

IB is a very high-quality company with the best research included for free in your account; the wealth of tools available is astounding. I like Portfolio Manager” because it offers something different from everyone else, backtesting and investment management based on the company fundamentals. Portfolio rebalancing and management with automated buying and selling are all included in the package for free, a world-class solution from an outstanding broker.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

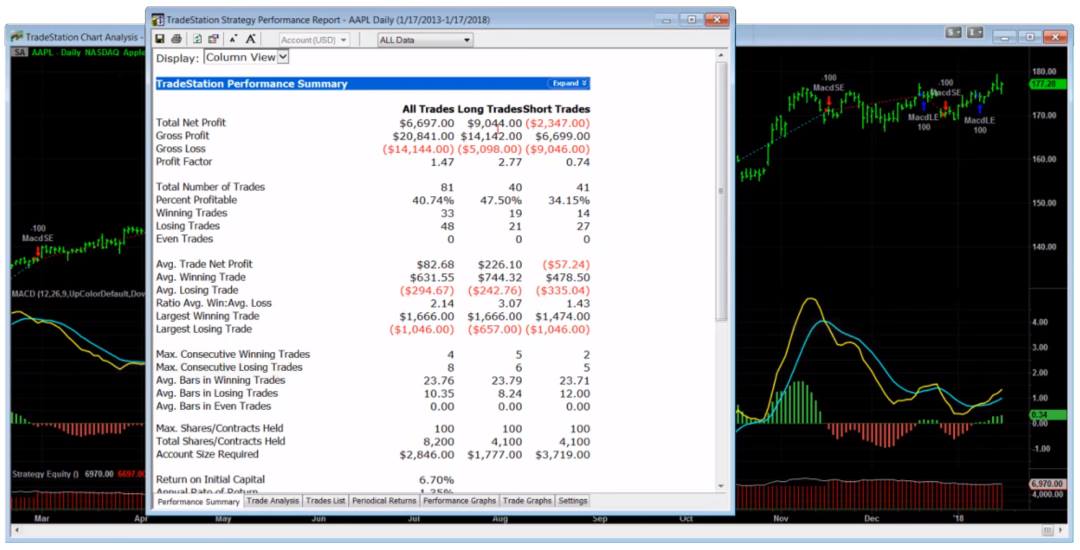

9. Tradestation: Great Backtesting For Tradestation Clients

TradeStation is a leading brokerage house with excellent execution and reasonable commissions, but did you know they have great backtesting software? TradeStation offers enough software and broker integration to stand tall with the other vendors.

| TradeStation Rating | 3.8/5.0 |

| ⚡ Features | Low-Cost Stock & Option Trades Globally |

| 🏆 Backtesting Features | Point & Click Backtesting & Auto-Trading |

| 🤖 Auto Trading | Yes |

| 🎯 Best for | US Traders |

| 💰 Cost Per Stock Trade | $1 |

Pros

- Powerful Charting Tools

- Good Algo and Power Tools

- Free Software for Brokerage Clients

- Broker Integration

Cons

TradeStation has real-time news, which is an excellent service, but it fails to score top marks because it does not provide market commentary or a chat community. But do you need that? Some people do; it’s a factor to consider. TradeStation offers TradeStation University a huge wealth of online videos to help you master their trading platform.

They also have a morning briefing that you can tune into online, and their selection of professional analysts will give an opinion on the market action and potential strategies.TradeStation has also cultivated a systems and strategies marketplace called the “Strategy Network,” where you can purchase stock market systems from an ecosystem of vendors or even contract someone to develop your system for you in the “Easy Lacharte” code.

TradeStation’s Backtesting Software

TradeStation’s unique proposition lets you create powerful technical backtesting scenarios directly from the charts. No need for programming or script development; it is straightforward. Select your chart, timeframe, and indicators and then plug in what parameters you want for the buy and sell orders. Long and short trades are all covered.

The beauty is that you can turn the hypothetical system into an automated trading system with algorithmic trading applications because this is a broker-integrated solution.

It is called TradeStation because it is the place where you can build a technical chart-based system and execute the system automatically.

Read the Full TradeStation Review

10. Quantshare: Low Price & Broker Agnostic Backtesting

Recommended for Quantitative Analysts who develop powerful automated systems and value a huge selection of shared user-generated ideas, but you need to be able to code.

| QuantShare Rating | 3.1/5.0 |

| ⚡ Features | Advanced Charts, Scanning |

| 🏆 Backtesting Features | Customized for Quants & Programming Skills |

| 🎯 Best for | Stock Traders |

| 🤖 Auto Trading | No |

| ♲ Subscription | Lifetime 1 Payment |

| 💰 Price | $245-$595/mo |

| 💻 OS | PC |

| 🎮 Trial | None |

| 🌎 Region | Global |

Pros

- For Quants Wanting To Automate Backtesting

- Super Cheap

- Active Community

- Very Good Backtesting

Cons

- Programming Knowledge Required

- Poor Interface

- Challenging to Use

QuantShare was new to me, and I was surprised by the feature set. Do you backtest, forecast, and program algorithms to get an edge in the market? Are you a hardcore programmer and mathematician? Then QuantShare is for you?

Stock Systems and Backtesting

QuantShare specializes, as the name suggests, in allowing Quantitative Analysts the ability to Share stock systems. They have a huge systems marketplace with a lot of accessible content that you can test and use. If you have a programmatic mind, you can implement and test an endless list of possibilities.

They do also offer Point & Click implementation of systems. What is great is they also have Artificial Intelligence integrations via the AI Optimizer, allowing the system to combine different rules to see which rules work best together. They also have powerful prediction models using Neural Networks. This is advanced software for those with programming skills.

QuantShare is difficult to use, and the interface requires serious development effort. The learning curve will take a time investment on your part.

Summary: Stock Backtesting Software Review

Trade Ideas deploys powerful AI backtesting software and auto-trading to give you a profitable edge in the stock market and is well worth the subscription. TradingView offers global market access, backtesting, auto-trading, and the biggest trading community globally. Finally, TrendSpider is our winner for innovation with AI pattern recognition, backtesting, and auto-trading via webhooks to your broker.

Backtesting Software FAQs

Which platform is best for backtesting?

For fully automated AI-driven backtesting Trade Ideas is the best. If you want to great your own unique trading strategies both MetaStock and TradingView are the best backtesting platforms.

Is there any free backtesting software?

From my testing, the best free backtesting software is TradingView, which allows users of their free basic plan to utilize the powerful Pine script strategy testing environment.

How reliable is TradingView’s backtesting?

Based on my backtesting and system development for the MOSES system, TradingView’s backtesting is extremely reliables and accurate. TradingView also provides on-chart entry and exit signals so you can prove the backtesting reliability.

What is Stock Backtesting?

Stock backtesting is a process used to test if a set of technical or fundamental criteria for stock selection has resulted in profitable trades in the past. A good backtesting system will report executed trades, the trade duration, the win/loss ratio, and the drawdown and compounded return.

For example, if your hypothesis is a stock with a positive RSI number and an increase in earnings will increase the stock price, then a stock backtest will prove if the strategy has worked in the past. The logic here is that if the strategy worked in the past, it might work in the future.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you avoid or minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens, so you can protect your portfolio. You will also know when the bear market is over, so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You A Prepared For Future Disasters

Source link

#Stock #Backtesting #Auto #Trade #Software